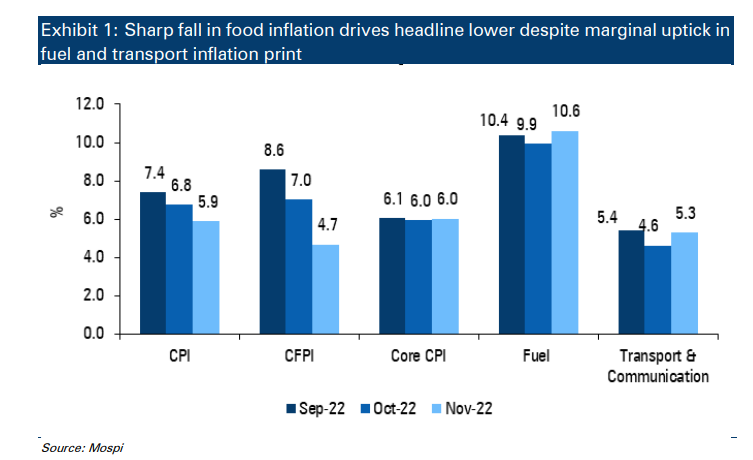

Lower vegetables drive food inflation, headline CPI lower

CPI inflation (November’22) stands at 5.88% YoY

Key readings

- CPI inflation for November came in lower at 5.88% vs. market expectation of 6.4% and 6.8% in October

- Like last month, the fall in inflation was led by food inflation with CFPI at 4.7% vs. 7.01%. Within food, vegetable inflation was the major driver with inflation at (-)8.1% vs. 7.8%. Other items that helped lower inflation were fruits (-2% MoM fall and favourable base), oil & fats (negative inflation continued for a second month on expected lines due to a fall in prices and favourable base)

- However, cereals (unfavourable base and continuous MoM rise), sharp MoM rise in eggs (6%), meat and fish (unfavourable base) and milk and products) put upward pressure on food inflation

- Cereals inflation with almost 10% weight has been a key driver of inflation in the last few months apart from vegetables. While vegetable inflation has declined in November for the first time since December 2021, cereals inflation should moderate from here on. Sowing acreage under Rabi crop currently is up 15% compared to last year. With global prices also trending lower, prices should move down, going forward

- Core inflation was almost flat at 6.02% vs. 5.95%. Fuel & light and transport & communications came in higher mainly due to base effect. On a YoY basis, health and household goods and services saw a minor acceleration at 7.7% YoY (vs. 7.6% last month) and 5.8% YoY (vs. 5.7% last month), respectively. Personal care and effects also remained elevated at 7.0% YoY (same as last month) due to higher gold prices (up 5.0% YoY). On the other hand, deceleration was seen in recreation and amusement at 5.4% YoY (vs. 6.1% last month) and clothing and footwear at 9.8% YoY (vs. 10.2% last month). Housing inflation remained stable at 4.6% YoY. Same was the case with education, which remained firm at 5.8% YoY (same as last month)

- Overall core inflation has been very sticky around 6.0% levels in the last two years

- Overall, over the next few quarters, core inflation is likely to be higher than the headline CPI print as most lead indicators suggest the moderation in food inflation will continue

- RBI had projected Q3FY23 CPI at 6.6%. With October and November average at 6.3% and December print likely around similar level, Q3 average is likely below their projection. While the RBI sounded hawkish in its recent policy and touched upon core inflation as well, the current CPI data print has opened up space to maintain status quo on the repo rate provided global variables, particularly the US Fed rate hike, remains benign

Source: ICICIdirect Research

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.