Israel-Palestine war and impact on the market

The attack by Hamas, a Palestinian militant group, killed over a thousand people in Israel over the weekend. The market on Monday was expected to react to the ongoing situation, and we saw the market fall on Monday. However, on Tuesday, the market bounced back and closed nearly a percent higher.

Does it mean we will not see any impact of the war on the Indian stock market? We are sure you would be interested in knowing the answer to this question. In this article, we look at the Israel-Palestine conflict and how it may impact the Indian stock markets.

The Conflict

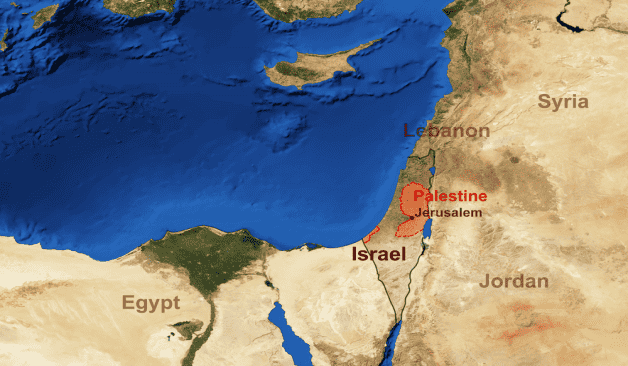

The conflict between Israel and Palestine is not new, and to understand it completely, we may need to go back in time - at least a few thousand years. Let us try to explain the conflict to you in a short but informative way.

The conflict between the two countries traces its origins back to the late 19th and early 20th centuries, when Jewish Zionists sought to establish a homeland in Palestine, then under Ottoman rule. The situation grew more complex with the British Mandate for Palestine following World War I and the mass immigration of Jewish settlers.

Tensions escalated in the mid-20th century, leading to the 1947 UN Partition Plan, which recommended the division of Palestine into separate Jewish and Arab states, with Jerusalem under international administration. While Jewish leaders accepted the plan, Arab leaders rejected it, resulting in the 1948 Arab-Israeli War. This war led to the establishment of the State of Israel and the displacement of hundreds of thousands of Palestinians, creating a refugee crisis that persists to this day.

Subsequent conflicts, such as the Six-Day War in 1967, further shaped the territorial boundaries and power dynamics in the region, with Israel occupying the West Bank, Gaza Strip, and East Jerusalem. The conflict involves competing claims to the same land, issues of self-determination, and the rights of refugees. Attempts at peace negotiations have occurred, but a comprehensive and lasting resolution remains elusive, with continued violence, settlements, and disputes over borders and sovereignty. The Israel-Palestine conflict remains one of the most complex and contentious issues in international relations, with implications for regional stability and global diplomacy.

The war is not new

The market across the globe has not reacted too much after the recent war started between the two countries. One of the reasons for it is that it is not happening for the first time, as mentioned above.

The two countries and the militant group Hamas have been in conflict with Israel for years. There have been dozens of wars, some small, while others have been on a larger scale. However, the current situation does not look good. There is a chance that the war will intensify.

The immediate impact

The short-term impact of the war is already visible. The major impact is on crude oil prices, which have surged nearly 5% since the war declaration. For India, if the crude oil price continues to rise, it could have a significant impact on some specific stocks and the broader economy.

Companies that use crude oil as a raw material have fallen in the last two days. If the price continues to increase and touches the three-digit mark, it might impact the Indian economy in some ways, because of this unexpected jump in price.

Here is how the rise in crude oil prices impacts the Indian economy:

- Trade Balance: India is a major importer of crude oil, and higher oil prices lead to an increase in the cost of oil imports. It can result in a trade deficit, as India has to spend more on oil imports, which can, in turn, put pressure on the country's current account balance.

- Inflation: An increase in oil prices will lead to higher fuel prices, which can trigger inflationary pressures, as we have seen in 2022. Transportation and production costs will increase due to rising fuel prices, which can lead to higher prices for goods and services across the economy, impacting consumers and businesses. We have been working hard to bring the inflation down or under control, another inflation spike will affect the economy adversely.

- Fiscal Deficit: The Indian government often subsidizes fuel prices to shield consumers from the full impact of rising oil prices. If the crude oil prices remain at their elevated level for longer, the government may need to increase subsidies or absorb a portion of the price increase, leading to a higher fiscal deficit.

- Currency Exchange Rate: A significant increase in oil prices can put pressure on the Indian rupee, as we have seen in FY23. Since India pays for oil imports in dollars, a higher oil import bill can lead to an increase in demand for dollars, potentially weakening the rupee against the dollar.

Experts believe that the war might not cause a major disruption in oil supplies and may not impact India significantly.

The worst-case scenario

As of today, the war is between the two countries. No other country has joined the war. However, the situation will change significantly if Iran, which is a major supporter of Hamas, joins the war. If that happens, it could lead to a spike in the crude oil prices which may lead to selling pressure in the market.

However, the good news is that other OPEC countries, like Egypt and Saudi Arabia, do not support the Hamas movement. Therefore, OPEC nations would be careful of the oil prices and may not let it rise beyond 10 to 12%, which will keep the number below the three-digit mark.

Israel-India trade impact

Israel imports or buys around $5.5 - $6 billion of refined petroleum products from India. In FY23, Israel's total imports from India stood at $8.4 billion. As per the Global Trade Research Initiative, Indian companies exporting products to Israel may have to pay higher premiums and shipping costs, which will reduce their profitability. As of now, there has not been any significant jump in premium costs or shipping charges, but if the war intensifies, the premium charges might increase every week.

India also imports products like machinery, pearls, diamonds, and other precious and semi-precious stones from Israel. As per available data, in FY23, India's total imports were $2.3 billion from Israel.

If the conflict escalates, it could create supply-side problems. If the trade gets impacted in the future, rupee depreciation is a possibility, and the currency may shift to the 83 or 84 mark.

What should investors do?

At present, investors must watch the development closely. If the war escalates, it could lead to a substantial correction in the market, which may present a buying opportunity for long-term investors. However, other than the impact of the oil price rise, there was no major impact of the war on the Indian stock market. However, investors must watch how other global markets do.

The earning session also kicks off on 11th October, and investors will have to be on top of their game to look at the short-term earning impact and the long-term war impact before making investment decisions.