How does RBI's increase in risk weight affect banks and NBFCs?

Last month, the Reserve Bank of India (RBI) tightened norms around an unsecured lending portfolio of NBFCs and Banks amid concerns of abnormally high growth in the loan category. In this article, we will understand the increase in risk weight and what it means for banks and NBFCs. More importantly, we look at the reasons: why RBI may have made this decision?

The Reason for Increase in Risk Weight

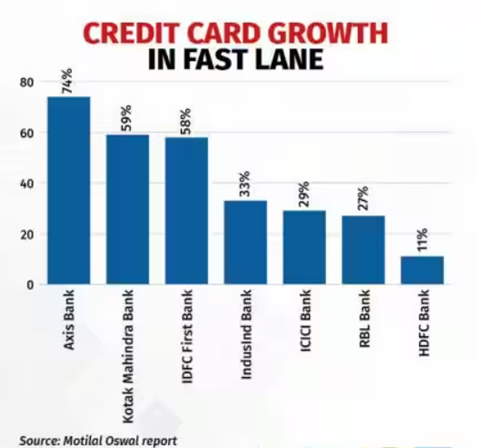

The Indian banks have witnessed a sharp rise in unsecured loans. Unsecured loans here refer to personal loans and credit cards. These loans have outpaced the overall bank credit growth by 15% over the past year, and the growth has drawn RBI's attention. Let us look at some growth numbers.

NBFCs’ credit growth in unsecured retail credit surged to 50% YoY during Q2FY23-Q2FY24. For banks, it revved to 34% in Q2FY24 over the previous year. The unsecured retail loans have been growing by 20-60% year-on-year (YoY) across all major lenders. Credit card growth, too, has been in the fast lane for most lenders. While Axis Bank’s credit card loans grew by 74% YoY, Kotak Mahindra Bank and IDFC First Bank reported 59% and 58% increase, respectively.

The Change introduced by RBI

To tackle this problem, the Reserve Bank of India has said that the consumer credit exposure for banks and NBFCs will attract a risk weight of 125% from 100% earlier. Consumer credit exposure excludes housing, education, vehicle, and gold-backed loans.

The risk weight for credit card loans by banks was fixed at 150% versus 125% earlier. Those by NBFCs will see a risk weight of 125%, up from 100%. At this point, it is essential to understand risk weight. So, let us shift focus there.

What is a risk-weighted asset?

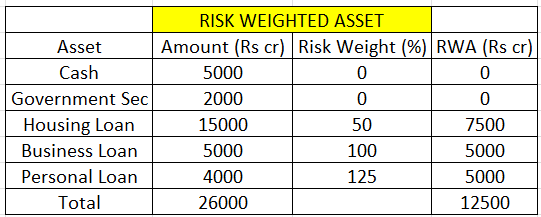

The term 'risk-weighted assets' (RWA) is commonly used in banking and financial regulation. It refers to the method of determining the minimum amount of capital that a financial institution, such as a bank, needs to hold to cover its credit risk. In a nutshell, risk-weighted assets are calculated by assigning different risk weights to different types of assets held by a bank. The idea is that not all assets pose the same level of risk, and the risk weight reflects the likelihood of default or loss associated with a particular asset.

The risk-weighted assets are then used to determine the minimum amount of capital a bank must hold to ensure it can absorb potential losses without jeopardizing its financial stability. The capital adequacy ratio (CAR), which is the ratio of a bank's capital to its risk-weighted assets, is a key metric used by regulators to assess a bank's financial health and ability to withstand economic downturns. So, if a bank gives a loan of Rs 100 and with CAR of 9% (for commercial banks) and risk-weight of 100%, the bank must set aside 100% of 9% of total loan, which is Rs 9.

Let us look at different assets and how risk weight works for them. As you can see, cash does not have any risk. Hence, the risk weight is zero. The same holds for government bonds. However, housing loans have a risk weight of 50%. Business and Personal loans have risk weights of 100% and 125%, respectively.

Let us look at how RBI's latest move changes things for the banks and NBFCs. Personal loans from our table fall under unsecured loans. With 100% risk weight, the risk-weighted asset (RWA) was Rs 4,000 crore. But with the latest move, when it increases to 125%, RWA has increased to Rs 5,000 crore. With CAR of 9%, bank now has to set aside Rs 450 crore (9% of 5,000) as against Rs 360 crore (9% of 4,000).

How does higher risk weight impact financial institutions?

A higher risk weight implies a higher capital requirement for a given exposure, potentially leading to a lower Capital Adequacy Ratio (CAR). This could force the institution to raise additional capital to meet regulatory requirements. As per market experts, the new RBI’s risk-weight order would spell double trouble for NBFCs and banks as loan growth is likely to slow down from here on.

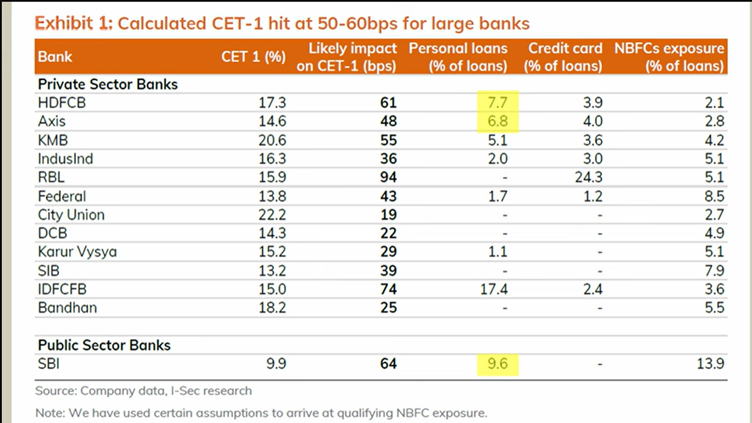

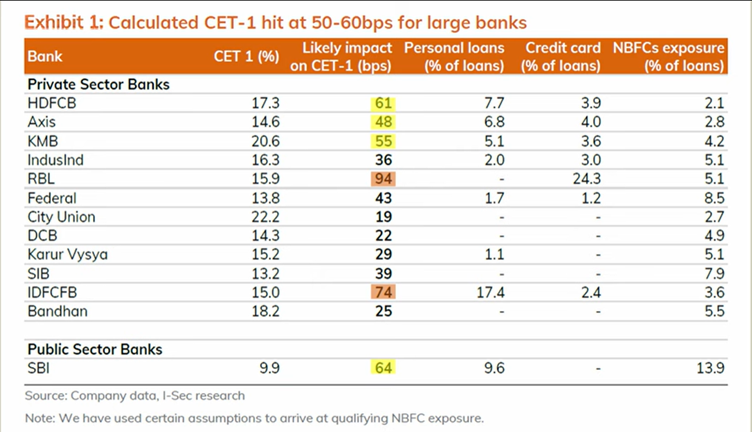

Here you can see that which banks have higher exposure to personal loan, credit cards and loans to NBFCs.

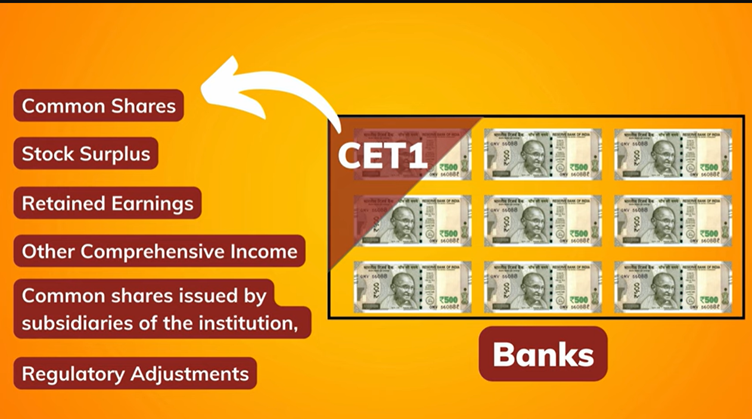

Another thing you need to understand is CET-1. It stands for Common Equity Tier 1, and it's a term commonly used in the context of banking and financial regulations. It consists of different components and is used to assess the financial strength and bank’s stability. Here are the things it consists of:

As the RBI has increased the risk weights, it is the CET-1 that gets impacted. As per our calculations banks will take a hit of 50-60 bps on their CET-1 as highlighted below. RBL and IDFC Bank would be the most hit.

Impact on NBFCs - NBFCs usually borrow money from the banks and lend it to end consumers. With higher risk weights, banks will charge higher interest to NBFCs and hence their borrowing cost will increase. Also, NBFCs have to allocate higher CRAR for each unsecured loan and therefore their margins will be impacted. Among big NBFCs, Bajaj Finance is expected to report a moderate margin impact, whereas SBI cards which has 100% unsecured loan will have a maximum impact on their margins and business.

Before you go

A higher risk implies that banks and NBFCs will have to set aside a higher amount for loan provisioning. It would impact the capital ratios of lenders and compel them to increase interest rates on such products to curb the impact on the return on equity. As a result, loans would be more expensive for borrowers from this measure. Alternatively, banks may have to reduce exposure to such loans to focus on segments that consume less capital. In a nutshell, this is precisely what RBI wants to achieve with its latest move.

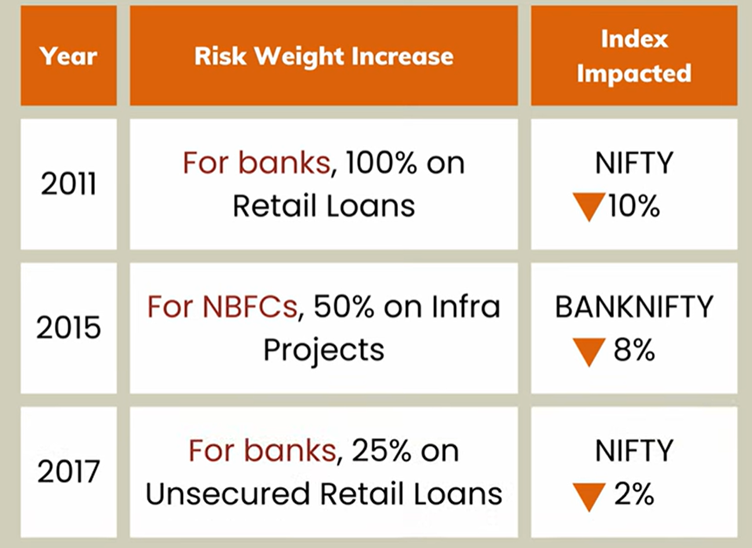

Every time the RBI has increased the risk weights for banks and NBFCs, there has been an impact on the broader market. Here is how the data looks like from recent years.

All banks and NBFCs have to put in place board-approved limits for unsecured consumer credit exposures in particular. All regulated entities must implement new rules no later than February 29, 2024. Banks and NBFCs with higher exposure to unsecured loans will be impacted more. On the other hand, housing finance companies will be tactical beneficiaries after this move.