Financial Planning and its three phases

In the technology field, the trending topic is Artificial Intelligence (AI), and in the financial space, the trending topic is financial planning. There is a similarity between the two - both things are trending, and only a handful of people understand them.

In the last couple of years, market experts, financial planners, and fin-influencers have been talking about the importance of financial planning. Today, we attempt to make you understand financial planning so that you can achieve your financial goals without hurdles. For we believe,

'INVESTING WITHOUT A FINANCIAL PLAN IS LIKE TAKING MEDICINE WITHOUT A PRESCRIPTION.'

The Problem

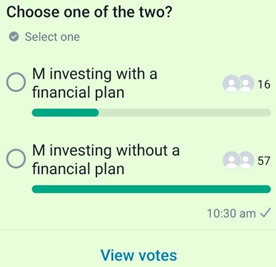

We did a small survey to see how people invest. Here is the result - Out of the 73 people who are investing, only 16 are investing with a financial plan - approximately 22%. The remaining are taking medicine without a prescription. We will understand the impact through an example.

Let us assume you plan a vacation in Goa (June-July is not the best time!!) from your current location - Mumbai. Can you pack your bag today and leave? Well, you can, but how your trip turns out to be - no one can take a guarantee of it.

If you need a peaceful and joyful trip, you need to plan. How are you going to travel (by bus or plane)? Where will you stay and for how many days? What places will you visit? Once you know the answers to these questions, the chances of your vacation going well is high (it is still not 100% - life is unpredictable).

The same holds for investing. You can only be a successful investor if you plan your investing. But how to plan a financial journey? For that, we need to understand financial planning. So let us get started with it.

What is financial planning?

Financial planning is about making a plan for your money. Just like you plan your day or activities, financial planning is about making decisions on how you want to save and spend your money.

First, you should think about your goals. What do you want to do with money you have? Do you want to plan vacations, save for something special, or maybe give money to charity? It is essential to have clear and defined (SMART) goals in mind and on paper.

Next, you need to think about how much money you have and how much you can save. From your total income, you can think about how much you want to save and how much you want to spend. It's good to save money for the future so you can have it when you need it.

Once you know how much you want to save, you can decide where to put your money. You can invest your money in fixed deposits, debt funds, the stock market, gold, or any other asset class which you think which help you achieve your goals.

It's like planting a seed and watching it grow into a big tree.

Financial planning is also about making choices. You may have to decide between buying something you want right now or saving for something bigger in the future. It is okay to spend money on things you enjoy, but it's also vital to consider your future needs.

Financial planning is about being responsible with your money. It's about making smart decisions, setting goals, and saving for the things that are important to you.

The three phases of financial planning

Now that you understand financial planning at a high level, let us go into the details. You can create your own financial plan (only if you are well-equipped), or you can take help from a financial advisor.

You can break your Goa vacation into phases. In the first phase, you decide the budget and duration. Next, based on the first phase outcome, you narrow down the places to visit and hotels to stay. Financial planning is divided into three parts. Let us look at the three phases of financial planning:

- Accumulation: It focuses on building wealth and saving for future financial goals. During this stage, you typically aim to increase your income, reduce expenses, and invest in various assets to grow your wealth over time. They might contribute to retirement accounts, like PF. Also, invest in stocks, bonds, real estate, or other investment vehicles. The primary objective is to accumulate sufficient funds to meet future financial needs.

- Preservation: In the preservation phase, you shift your focus from aggressive wealth accumulation to protecting existing assets. The second phase usually begins as retirement approaches or when financial goals become more short-term. The preservation phase involves adopting a more conservative investment approach with a focus on capital preservation and reducing exposure to asset classes with high risk and volatility. It often includes strategies like diversification, asset allocation, and risk management to safeguard accumulated wealth and maintain its value.

- Distribution: The distribution phase occurs when you start utilizing your accumulated assets to generate income and meet your financial needs. It begins at or during retirement when you transition from saving and investing to drawing income from your investments and other sources. The key considerations in this phase include determining an appropriate withdrawal strategy, managing tax implications, and ensuring sustainable income to support your lifestyle throughout retirement. You may choose to take regular withdrawals, set up annuities, or establish other income streams to cover expenses.

Final thoughts

Before you go, we would like to highlight two crucial points:

- Financial planning is not a one-time activity. It is an ongoing exercise, and we request all our readers to invest with a clear financial plan.

- The phases are not necessarily rigid or mutually exclusive. The specific timing and duration of each phase can vary depending on individual circumstances and financial goals. Some individuals may experience overlaps between phases or have different priorities that alter the progression.

We hope the article was helpful and you will create your financial plan.