Equity savings funds: Can it be a suitable addition to your portfolio?

The equity markets have been rallying for the past few months, though there is occasional volatility. As a general consensus emerges among analysts and economists on interest rates being close to their peak, select fixed income options look attractive.

But the background of a global economic slowdown, geopolitical factors and some export-oriented sectors facing a reduced demand environment could mean that interest rates may continue to stay high for a while, while equities could gyrate. Valuations, too, aren’t very comfortable.

As such hybrid strategies may be ideal for such an environment for investors who are uncertain and have a moderate risk appetite.

However, the finance bill took away the indexation benefits in debt funds (and hybrid schemes with less than 35% equity) and removed all classifications of gains – long or short term – and has made all the profits taxable at the applicable slab rate.

Even so, investors with a moderate risk appetite and wanting debt-like or slightly better fixed income returns without too much volatility have an option. What’s more there is also the benefit from equity-like taxation on gains.

That’s where equity savings funds from the hybrid category come into the picture and fit the requirement perfectly. The category of funds invests in a mix of equities, derivatives and bonds to create a portfolio that is geared to deliver steady returns with low volatility and risks.

Here’s more on how equity savings funds could be a suitable addition to investors’ portfolios in the present market conditions.

Accruals and arbitrages

Market regulator SEBI’s guidelines for equity savings schemes, which fall under the hybrid category, state that a minimum of 65% of the portfolio in such funds must be invested in equity and equity related investments (including derivatives), and a minimum of 10% in debt instruments. Derivatives are allowed for hedging purposes. These derivatives mostly use arbitrage opportunities to insulate portfolio risks and generate accruals for the portfolio.

There are predominantly two strategies deployed by funds in the category.

Cash-futures arbitrage: This strategy involves buying a share in the cash market. The fund manager would also short (sell) the stock of the same company in the futures market, if it trades at a higher price than in the cash market. For example, let’s say a stock trades at Rs 100 in the cash market and Rs 103 in the futures market. The fund manager will buy in the cash market and sell in the futures market. During the expiry of the derivatives contract, three scenarios could emerge.

If the stock remains at Rs 100, then the investor will gain Rs 3 per share from the sale in the futures market (103-100). In case the stock moves to Rs 110, there will be a Rs 7 loss in the futures market (110-103). However, there is a Rs 10 gain made in the cash market (110-100), resulting in a net gain of Rs 3 per share (Rs 10 gain – Rs 7 loss). Consider a scenario when the share price falls to Rs 95. The loss in the cash market would be Rs 5 (100-95). But the gains in the futures market would be Rs 8 (103-95). Therefore, the resulting net gain would be Rs 3 (Rs 8 gain - Rs 5 loss).

Thus, the fund manager makes a fixed gain in all three scenarios (ignoring brokerage, STT and other costs). This strategy ensures that the arbitrage strategy provides a low-risk accrual to the portfolio.

Covered call options strategy: Usually, the fund manager holds a long position in a stock and sells (writes) a call option on the underlying stock. Let’s say the stock trades at Rs 100 in the cash market and the call premium is Rs 3 for a strike price of Rs 110. During expiry, if the price remains at Rs 100, then the buyer will not exercise the call option since it is out of money (strike price is more than current price) and the fund manager pockets the Rs 3 premium. If the stock price increases to Rs 112, the call option will be exercised. Therefore, the fund manager will receive Rs 110 strike price and Rs 3 premium. So, he still makes a small gain of Rs 1.

In case the stock price falls to Rs 90, the call option will not be exercised, the fund manager will lose Rs 10 on the stock, but gains Rs 3 premium, thus limiting the overall loss to Rs 7.

In both these strategies, the focus is on generating low-risk returns and ensuring regular accruals to the portfolio via premiums. These strategies will work only if there are sufficient arbitrage opportunities available.

Reasonable returns and low taxes

While arbitrage strategies or derivatives usually account for a bulk of equity savings funds’ portfolios – anywhere from 20% to 60% – regular stocks and debt securities are also used.

There are no restrictions on which kind of stocks and debt securities can be invested in. The fund manager can invest in safe stocks and debt securities (following any strategy such as duration, accrual, rolldown etc.) to ensure moderate returns with low volatility.

Equity savings funds can be a good addition to debt and equity funds for an investor’s portfolio to generate risk-adjusted returns. You must consult your financial advisor to understand where these funds fit in your overall portfolio.

The basic idea must be to beat inflation via these funds with minimal risks.

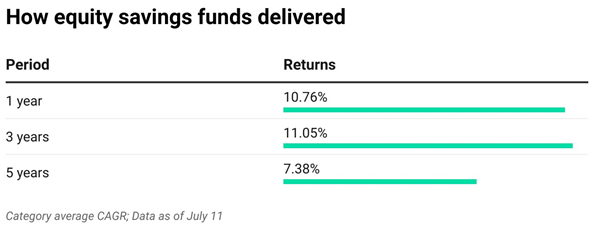

The returns given by the equity savings funds category over the years is illustrated below. Typically, these funds are able to beat inflation convincingly and deliver more than debt fund returns.

An important advantage that equity savings funds enjoy over other debt or a few hybrid categories is that they enjoy equity taxation.

According to the tax laws if equity and equity derivatives form 65% or more of a portfolio, equity taxation would be applicable.

Long-term gains (made in a holding period of 1 year or more) up to Rs 1 lakh are tax free in a financial year. Beyond Rs 1 lakh, gains are taxed at a flat rate of 10%. Thus, post-tax returns are likely to be healthy and beat inflation.