Cash Flow Statement: What It Is, How to read, and examples

How can you check a company's financial position, operational efficiency, and strategic decisions? One of the best ways to do so is by looking at the cash flow statement. But it sounds a bit complicated, right? To be honest, it is. But in this article, we will ensure that you explore what a Cash Flow Statement is, how to read it and provide examples to illustrate its importance.

What is a Cash Flow Statement?

The Cash Flow Statement (CFS) is one of the essential financial documents that provide valuable insights into a company's liquidity, solvency, and overall financial health. It is one of the three main financial statements, alongside the Income Statement and Balance Sheet (we will cover later). It is essential not only for the company's stakeholders but also for investors as it helps to understand a company's ability to generate cash and meet its obligations. As we cover more topics around cash flow statements, you will better understand them.

How the Cash Flow statement is used?

The Cash Flow Statement is a crucial financial document that provides valuable insights into a company's cash position and how it manages its cash flows. Let us look at how you can use a cash flow statement:

- They are used to evaluate a company's ability to meet short-term obligations.

- Assess the company's liquidity and ability to cover current liabilities with available cash.

- Investors can examine the operating cash flow section to gauge the company's ability to generate cash from its core business activities.

- Looking at the details, investors can assess whether the company is making strategic investments or divesting assets.

- It is used to assess the impact of debt repayments and equity issuances on the company's financial structure.

- Investors can consider the Cash Flow Statement in conjunction with other financial statements for comprehensive valuation.

Structure of the Cash Flow Statement

The cash flow statement is divided into three main sections. Each section provides a detailed account of the sources and uses of cash during the reporting period. Here are the three sections:

1. Operating Activities: This section outlines the cash generated or used in the company's core business operations. It includes cash received from customers, payments to suppliers, employee salaries, and other day-to-day operational transactions. You can understand the significance of this section by understanding what it suggests. Positive Operating Cash Flow indicates the company is generating sufficient cash from its core operations. Negative cash flow may suggest operational challenges.

2. Investing Activities: Investing Activities focus on the company's capital expenditures and investment activities. It includes cash spent on acquiring or selling long-term assets, such as property, plant, equipment, and investments in securities. What does it tell you? Positive Investing Cash Flow may indicate strategic asset sales or profitable investments. Negative cash flow may reflect substantial capital expenditures.

3. Financing Activities: Financing Activities involve cash transactions with the company's investors and creditors. This section includes activities like issuing or repurchasing stock, obtaining or repaying loans, and paying dividends to shareholders. Positive Financing Cash Flow may result from fundraising activities. Negative cash flow may occur when repaying debt or distributing dividends.

Limitations of the Cash Flow Statement

As we have seen in previous sections, the Cash Flow Statement is a valuable tool for assessing a company's liquidity and financial health, but, we would like to highlight that it does have some limitations. You need to be aware of these limitations when interpreting the statement and making financial decisions. Here are some of its limitations:

The CFS focuses on cash movements, not profitability. A company can have positive cash flow while reporting a net loss due to non-cash expenses such as depreciation.

A negative cash flow, on the other hand, should not immediately raise a red flag. If the company is expanding its business, it can have poor cash flow which can be good in the future for the company.

While the Cash Flow Statement provides information about the quantity of cash flows, it does not offer insights into the quality of earnings. A company may have positive cash flow from operating activities, but it may be unsustainable or driven by aggressive accounting practices.

The best thing for investors should be to consider the cash flow statement with the Income Statement and Balance Sheet to decide whether the company will taste success or can go bankrupt.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

Here is a comparison of the three:

|

Aspect |

Cash Flow Statement |

Income Statement |

Balance Sheet |

|

Purpose |

Describes cash inflows and outflows over a period. |

Summarizes revenues, expenses, and profit or loss over a period. |

Provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. |

|

Time Period Covered |

Typically covers a specific period (e.g., a month, quarter, or year). |

Summarizes activities over a specific period (e.g., a month, quarter, or year). |

Represents a company's financial position as of a specific date. |

|

Focus |

Emphasizes cash transactions only. |

Focuses on revenues, expenses, and profitability. |

Shows assets, liabilities, and equity, providing a holistic view of the financial position. |

|

Components |

Three main sections: Operating Activities, Investing Activities, Financing Activities. |

Revenues, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Net Income, Earnings per Share (EPS). |

Assets (Current and Non-current), Liabilities (Current and Non-current), Equity (Common Stock, Retained Earnings). |

|

Net Result |

Net Cash Flow (sum of three activities) represents the change in cash position. |

Net Income represents the profit or loss after all expenses and taxes. |

Assets must equal liabilities plus equity (Assets = Liabilities + Equity). |

|

Adjustments for Non-Cash Items |

Includes adjustments for non-cash items (e.g., depreciation, changes in working capital). |

Includes non-cash items (e.g., depreciation, amortization) that impact profitability but not cash flow. |

Does not account for non-cash items; values are reported based on historical cost. |

|

Role in Decision-Making |

Used to assess a company's liquidity, operational efficiency, and cash management. |

Assists in evaluating a company's profitability and performance. |

Provides insights into a company's financial position and its ability to meet long-term obligations. |

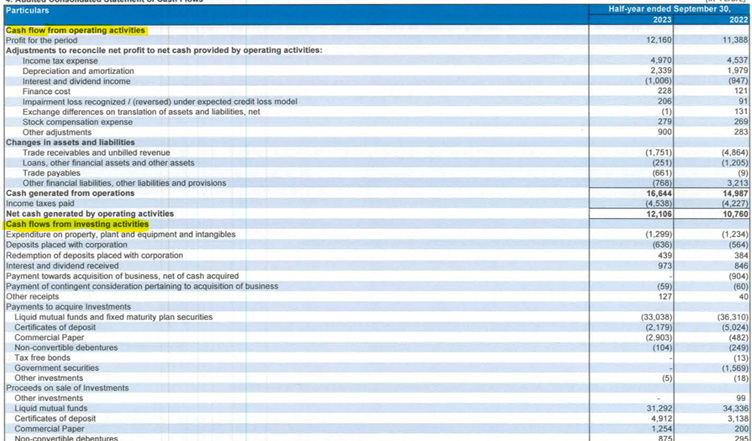

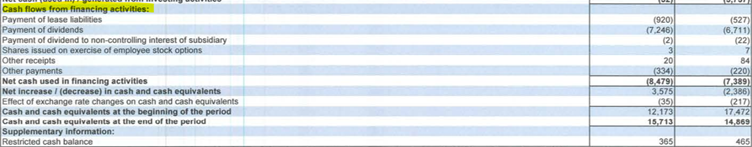

Example of a Cash Flow Statement

We have covered everything related to the Cash Flow Statement, and now you may want to see an actual cash flow statement. Here is the Infosys Cash Flow Statement. You can see Operating Cashflow, Investing Activities, and Financing Activities in the below image (highlighted in yellow). You can check what is covered under each of them for better understanding.

What Is the Difference Between Direct and Indirect Cash Flow Statements?

The Direct and Indirect methods are two ways of presenting the Cash Flow Statement, and they differ in how they report cash flows from operating activities. Here are the key differences between Direct and Indirect Cash Flow Statements:

|

Aspect |

Direct Cash Flow Statement |

Indirect Cash Flow Statement |

|

Objective |

Reports actual cash inflows and outflows directly. |

Adjusts net income to derive cash flow from operating activities. |

|

Information Source for Operating Activities |

Directly uses cash transactions related to operating activities. |

Starts with net income and adjusts for non-cash items and changes in working capital. |

|

Format of Presentation |

Reports cash inflows and outflows by category (e.g., receipts from customers, payments to suppliers). |

Begins with net income and adjusts for changes in balance sheet accounts to derive operating cash flow. |

|

Transparency |

Provides a clearer, more straightforward view of cash movements. |

Requires users to analyze adjustments, making it less intuitive. |

|

Common in Practice |

Less common. Often used in small businesses or industries where direct cash flows are more apparent. |

More common. Widely used in financial reporting and analysis. |

|

Preparation Complexity |

Generally simpler to prepare since it relies on actual cash transactions. |

May involve more complex adjustments, especially for large companies. |

|

Granularity of Information |

More granular, providing detailed insights into cash transactions. |

Less granular, as it focuses on adjustments to net income. |

|

Primary Focus |

Directly focuses on cash transactions. |

Primarily focuses on reconciling net income to cash from operating activities. |

Conclusion

Analyzing a Cash Flow Statement is essential for investors, creditors, and other stakeholders to make informed decisions about a company's financial health. By understanding the components of the statement and interpreting the examples provided, individuals can gain valuable insights into the cash position and financial stability of Indian companies.