Benchmark Index for Mutual Funds

Mutual fund X delivered better results than its benchmark. We often hear statements like these, and if you are new to mutual fund investment - the obvious question would be - what is a benchmark index? Invest your time in this article to learn about benchmark indexes so you can make the most of the mutual funds.

What is the benchmark index for MF?

A benchmark index is a reference point used to compare the performance of a mutual fund. It is essentially a basket of securities that represents a particular market segment, like large-cap stocks. By comparing an MF's returns to its benchmark index, you can see how well the fund has performed relative to the broader market it invests in. The specific index used depends on the fund's investment objective. For example, a large-cap fund might be benchmarked against the Nifty 50 index, which tracks the performance of the 50 largest companies in India.

Importance of benchmarking

In this section, we look at the importance of benchmarking:

Performance Comparison: You scored 40 marks in an examination. Is it good or bad? It would be difficult to say unless we know your friend's mark, right? There has to be a benchmark to compare something. Benchmarking allows you to compare the performance of a mutual fund against a relevant market index or peer group. At the end of the day, you put your money in active funds because you want to generate alpha (more on this later). By measuring a fund's returns relative to its benchmark, you can assess whether the fund has outperformed or underperformed its expected level of return.

Risk Assessment: Benchmarks help you evaluate the risk-adjusted performance of mutual funds. By comparing a fund's risk-adjusted returns, as measured by metrics such as the Sharpe ratio (covered later), to those of its benchmark, you can find whether the fund's returns are commensurate with the level of risk taken.

Investment Strategy Alignment: Benchmarks provide insight into a mutual fund's investment strategy and objectives. Funds typically select benchmarks that closely resemble their investment focus, asset allocation, and geographical exposure. By comparing a fund's performance to its benchmark, investors can assess whether the fund manager is effectively implementing the stated investment strategy.

Setting Realistic Expectations: Benchmarks help you set realistic performance expectations for mutual funds. You can look at the historical performance of the benchmark index, establish a baseline for expected returns, and assess whether a fund's performance aligns with those expectations over time.

Measuring MF performance against benchmark

Now that you understand the basics of benchmarking - let us look at how exactly you can measure the mutual fund performance against the benchmark. The first step in measuring mutual fund performance against a benchmark is to select an appropriate benchmark. The benchmark should reflect the investment objectives, asset class, and geographic focus of the mutual fund. For large-cap funds, the benchmark could be Nifty50, while for small-cap funds, the benchmark could be Nifty Smallcap 100.

Next, you determine the performance measurement period, such as one year, three years, or five years, depending on your investment horizon and goals. Longer periods provide a more comprehensive assessment of a fund's performance, accounting for market cycles and volatility. Third, calculate the total returns of the mutual fund and the benchmark over the selected measurement period. Total returns include capital appreciation (or depreciation) and any income generated by the investments, such as dividends or interest.

Now, returns should not be the only criteria as part of benchmark comparison.

Ratios in benchmarking

Here are some ratios you can check to compare the performance of your mutual fund with the benchmark:

Alpha: It measures the excess return of the MF compared to its benchmark after adjusting for a risk-free rate. A positive alpha indicates the fund manager's ability to outperform the market through security selection.

Beta: It measures the volatility of the MF relative to its benchmark. A beta of 1 indicates the fund's volatility matches the benchmark. A beta greater than 1 suggests the fund is more volatile, and vice versa. Beta helps understand the risk associated with the alpha (outperformance or underperformance).

Sharpe Ratio: This combines return and risk. It measures the excess return (above the risk-free rate) earned per unit of volatility. A higher Sharpe Ratio indicates better performance when adjusted for risk.

R-Squared: It measures how closely the MF's returns track the benchmark's returns. A value of 1 indicates perfect correlation, while 0 indicates no correlation. A high R-squared suggests the fund's performance is heavily influenced by the benchmark, while a lower value might indicate the fund manager has taken on more active bets that may deviate from the benchmark.

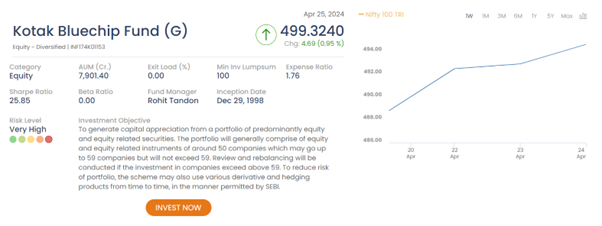

How to look at benchmark returns at ICICI Direct?

You can visit www.icicidirect.com and look for your fund. If your fund is Kotak Bluechip, you can search it on the website, and all the fund's details will be available. At the top, you will see its Sharpe Ratio and Beta Ratio.

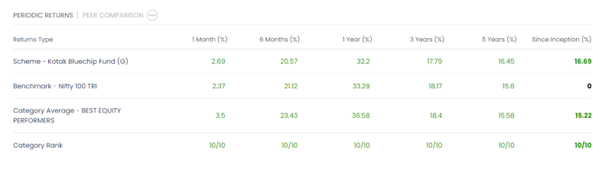

To check the returns, scroll down a bit, and you will see the periodic returns of the fund, and you can compare it with the benchmark.

Before you go

Benchmark indices play a vital role in evaluating the performance of mutual funds and guiding investment decisions. It gives you the option to compare a fund's performance against a relevant benchmark, which allows you to assess its relative strength, risk-adjusted returns, and adherence to investment objectives. Understanding the selection, construction, and interpretation of benchmark indices empowers you to make informed choices and get the best possible returns on investment.