Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- The third largest telecommunications service provider in India based on subscriber base

- The sixth largest cellular operator globally in terms of number of subscribers in a single country of operations.

-As of December 31, 2023, they had over 223.0 million subscribers and a subscriber market share of 19.3%

Large Subscriber Base

As of December 31, 2023, we had over 223.0 million subscribers and our subscriber market share was 19.3%. During the quarter ended December 31, 2023, they had a leading applicable gross revenue market share in the Kerala and Mumbai service areas, and the second largest market share in the Gujarat and Kolkata service areas. For the same period, their market share was over 20% in the Maharashtra, Delhi, Uttar Pradesh (West) and Haryana service areas. (source: TRAI Subscription Report)

Extensive Telecommunication Network

They have a large network infrastructure of 2G, 3G, and 4G equipment, along with a nationwide fibre optic cable network. As of December 31, 2023, they operate approximately 183,400 unique tower locations across more than 487,000 towns and villages in India, and offer broadband services (3G and 4G) at more than 438,900 broadband (3G and 4G) units, covering over a billion people.

Existing Network Built on 5G-Ready Architecture

Their 4G network has been strategically deployed with a future-proof architecture, and all their new basebands and over 90% of time division duplex (“TDD”) 2500 MHz band radio units are 5G-ready with 10G bandwidth capability. They have also deployed various advanced 5G technologies for improved capacity, and open radio access network (“ORAN”) for increased flexibility (Source: Company RHP)

Company has incurred significant indebtedness

Their obligations to the Government of India for AGR and DPO accounted for more than 97% of their borrowings, as of February 29, 2024.As part of the Telecom Reform Package, they opted for a four year moratorium towards deferment of spectrum payment obligations related to spectrum auctions conducted until 2016 and AGR dues until FY19.At the end of four year moratorium, they may not be able to meet obligations, which could adversely affect credit rating, business, results of operations, financial condition and cash flows. (Source: Company RHP)

They face intense competition that may have an impact on their market share and profitability

Competition in the Indian telecommunications industry is intense. Competition may affect their ability to competitively bid for spectrum that the Government intends to auction, may result in decline in subscriber base, cause a decrease in realisation rates and average revenue per user (“ARPU”), an increase in subscriber churn and an increase in selling and promotional expenses, all of which could have an adverse effect on business and results of operations. (Source: Company RHP)

- Increasing number of subscribers: Between Financial Years 2014 and 2020, TRAI reported an increase in subscriber base by 200 million i.e., 33 million yearly, aided by increasing affordability of devices, low tariffs and digital adoption. As of December 2023, the total subscriber base in India reached 1,190.33 million, out of which wireless subscribers were 1,158.49 million and the remaining 31.84 million were wireline subscribers.

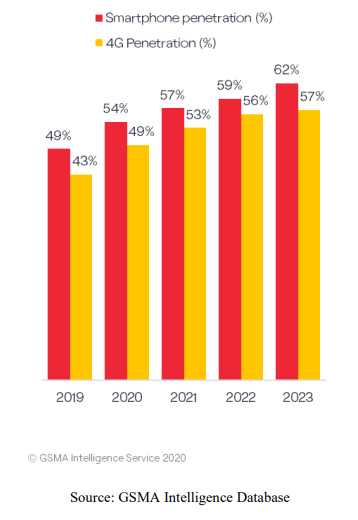

- Smart Phone adoption on rise: Penetration of smartphones in India has been increasing due to growing availability of affordable smartphones and gradual reduction in data tariffs and increasing income levels. However, there remains significant headroom for smartphone penetration to improve going forward.

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

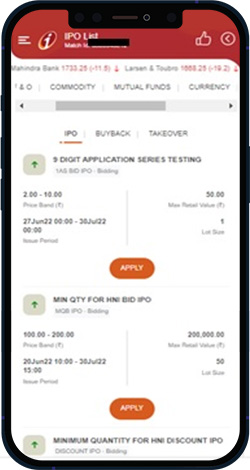

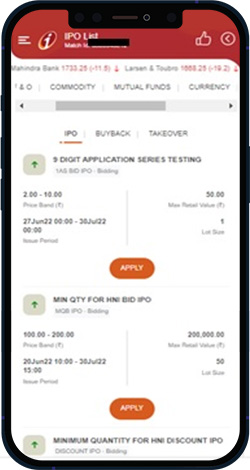

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

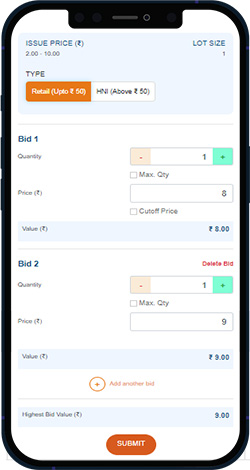

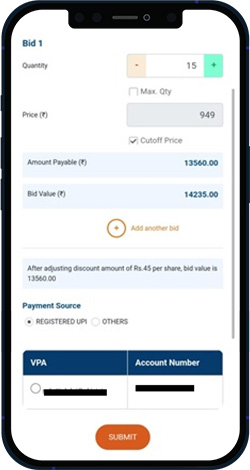

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

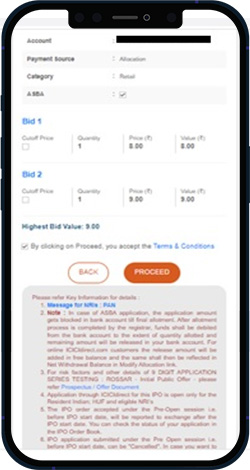

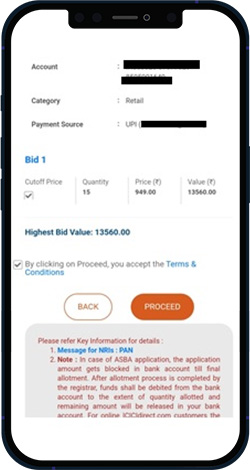

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.