*Investments in the securities market are subject to market risks. Read all the documents carefully before investing.

*Investments in the securities market are subject to market risks.

Read all the documents carefully before investing.

Enjoy an interest rate as low as 0.0265% per day

Buy stocks by paying only a fraction of the order amount

Trade across a wide range of 1400+ stocks

Utilise exclusive, research-backed recommendations

Get short term investment ideas backed by research

| Brokerage Plan |

MTF Interest Rates (Per Annum) |

MTF Interest Rates (Per Day) |

Delivery Brokerage |

|---|---|---|---|

|

₹ 9,999

ONE TIME

|

9.65% | 0.0265% | 0.07% |

|

₹ 4,999

ONE TIME

|

9.65% | 0.0265% | 0.10% |

|

₹ 2,999

ONE TIME

|

16.49% | 0.0451% | 0.15% |

|

₹ 999

ONE TIME

|

17.99% | 0.0492% | 0.22% |

|

₹ 299

ANNUAL

|

17.99% | 0.0492% | 0.25% |

|

Default Plan

|

17.99% | 0.0492% | 0.29% |

A charge of ₹25 + GST applies per pledge/unpledge transaction.

Leverage amplifies both profits and losses. Ensure you have a clear understanding of the risks before proceeding.

If there’s a margin shortfall, your positions may be squared off. Track this under Open Positions.

MTF positions can be held for up to 360 days. Plan your trades accordingly.

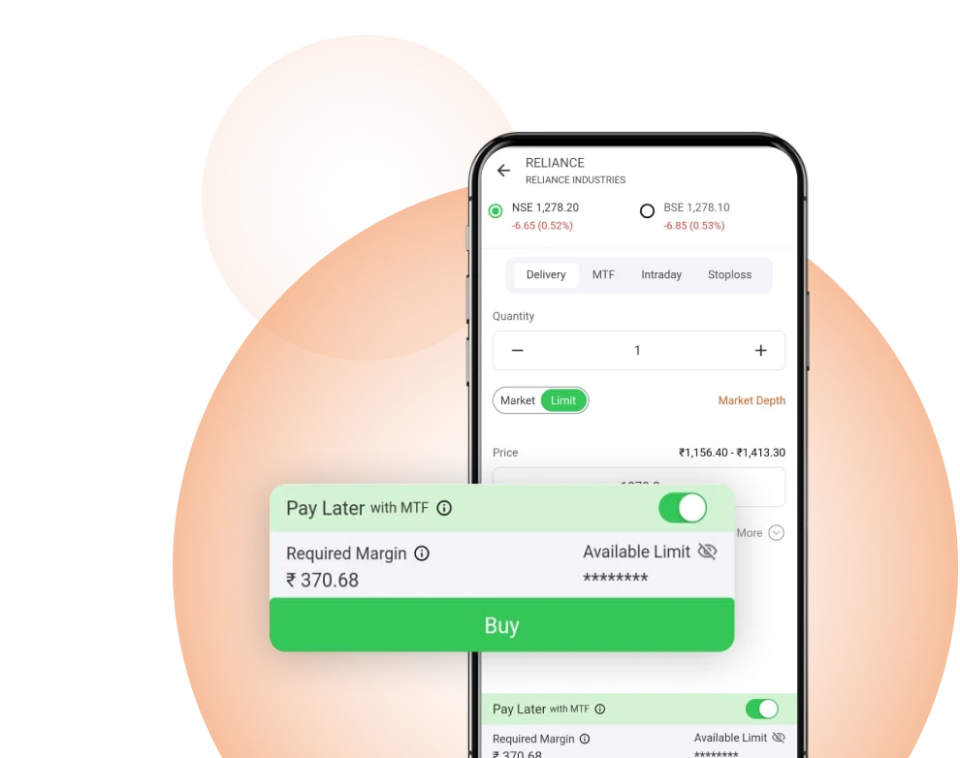

Go to the Watchlist > Search for the stock you wish to buy > Click B.

Select Delivery > Enter order details > Toggle "Pay Later"

Check required margin > Click Buy

View your current positions under Open Positions:

Search or select your desired stock and click Buy.

Select Delivery > Toggle "Pay Later" > Enter order details

Review Order Details > Swipe to Buy purchase.

Check Open Positions to monitor your MTF holdings.

The securities are quoted as an example and not as a recommendation.

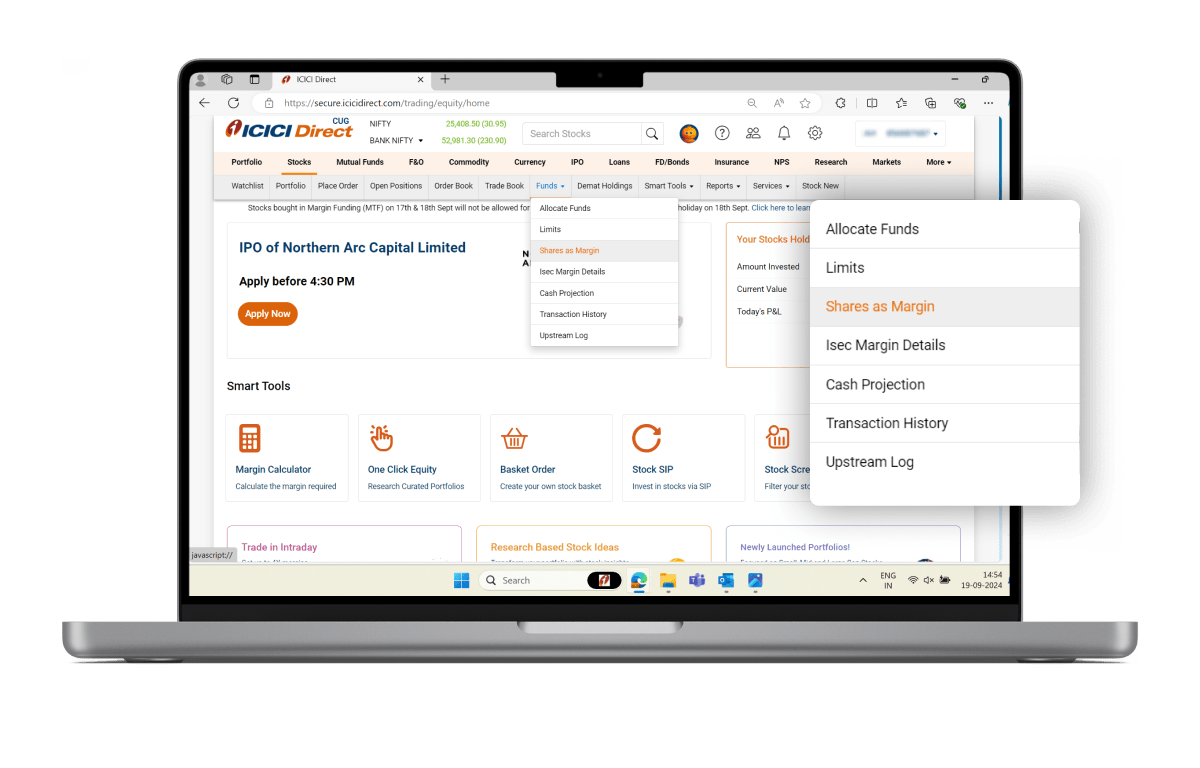

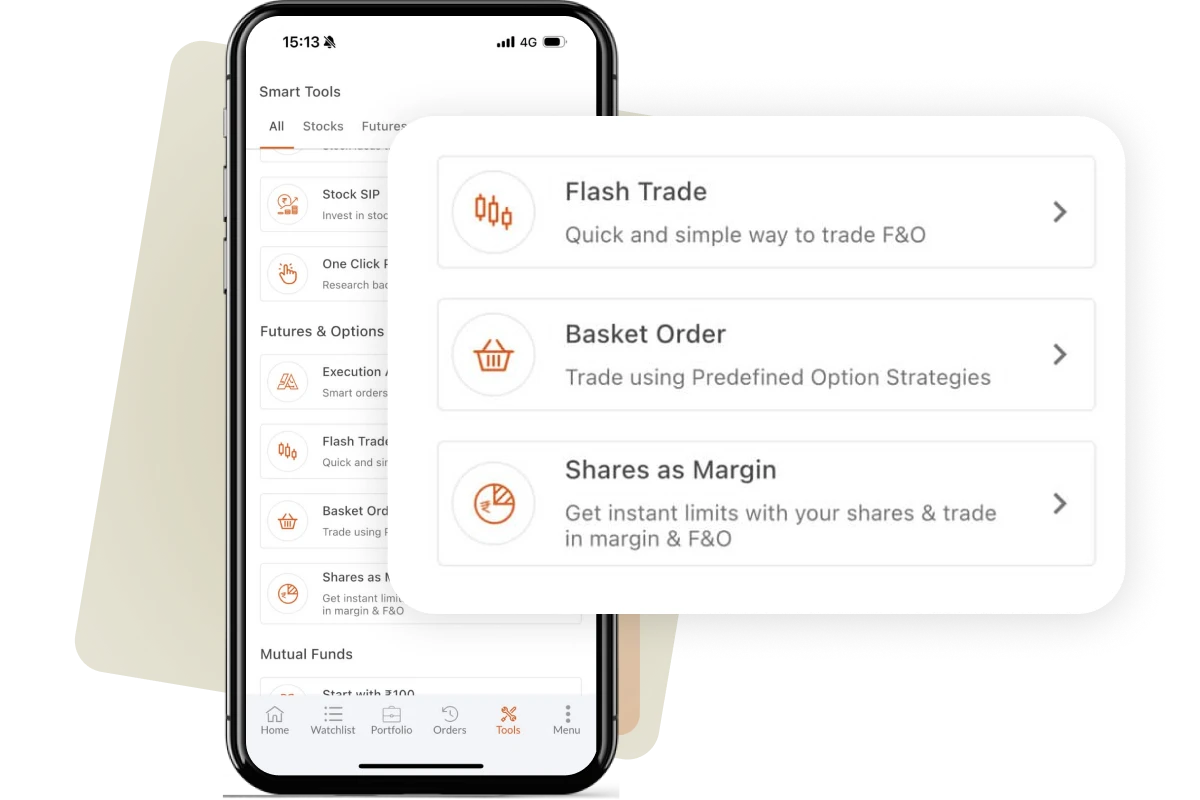

Use your existing Shares as Margin (SAM) instead of cash to buy stocks with MTF

Go to Stocks → Funds → Shares as Margin

Enter the quantity of the stocks you want to pledge.

To create limits, select the equity segment, enter the OTP, and submit.

Trading limits are created instantly and visible under Securities Allocation.

You can buy stocks by paying an initial small amount called the margin amount, while the remaining outstanding amount is funded by ICICI Direct.

You can sell/square off the stocks anytime or convert them to delivery (CTD) within the expiry date. Interest is charged on the funded value.

In other words, MTF is a leveraged investment product that allows you to buy shares using cash or collateral/pledged shares (SAM).

Unlike a cash buy order, you do not have to pay the full order value for an MTF order upfront. MTF positions have a default maximum validity (expiry) of 360 days from the date of purchase.

Let us assume you have found an investing/trading opportunity which costs ₹4,00,000, but you only have ₹1,00,000 in your bank account. Normally, you will not be able to take advantage of this opportunity. But, with MTF offering up to 4 times leverage, you can take the position, provided the stock qualifies.

Break-up

The funded amount attracts interest, starting as low as 9.65% per annum, depending on your brokerage plan. This position can be held for up to 360 days.

The interest rate for MTF is as low as 9.65% p.a. depending on your brokerage plan. Interest under MTF is charged on the funded amount for the number of days you hold the position.

For example, if you buy 4 shares worth ₹4,00,000 with ₹1,00,000 of your own funds, ICICI Direct funds the balance of ₹3,00,000.

You can use the MTF Calculator to estimate charges in advance.

The calculation starts from the exchange pay-in date of the settlement i.e. T+1 day and continues till the date the funds are settled i.e. T+1 day of the position being squared off. Interest is applied on a per-day basis, including weekends and non-working days.

We offer MTF on 1400+ stocks. You can check the stock list to see what stocks are eligible for MTF.

Stocks purchased under MTF can be held for up to 360 days. To ensure your positions do not get squared off due to a margin shortfall, ensure you maintain adequate funds in your account and monitor you positions regularly.

* Interest rate depends on your brokerage plan