Implication of F&O peak margin debit & credit in your bank statement

As per regulatory mandates, margins have to be collected upfront for all Trades in equity and derivatives. At ICICIdirect, we have always ensured that before entering any trade, applicable margins have been blocked in your account.

Further, regulations require that the upfront margin should be in possession of broker instead of only allocation in the Bank account.

To comply with this, for any transaction entered by you, the applicable margin (which is blocked in your account during the day) will be debited at the end of day and any un-utilised margin will be credited back to your bank account.

This will have no implication on your trades, margins or positions, only that you will see additional debit and credit entries in your Bank account.

What is peak margin which will be debited and credited?

Your highest margin utilization on the Trade Date or highest Limit utilization on order placement level & status change (such as cancellation) is considered as Margin required for the day.

This money will be debited in the evening and any un-utilised margin will be credited back to you bank account.

If I place an order but that’s not executed, will that be debited and credited back to Bank account?

Limit utilization and hence Peak Margin happens at order placement level (so even before order execution Limit gets utilized) across all products in F&O.

Thus even if this order gets cancelled/ rejected/position is squared off and limits are released but Peak Margin Amount won't get reduced and it will remain blocked while deallocating funds from FNO Allocation. However, available limits as per released limits can be utilized by you for trading.

To illustrate with an example: If customer creates position requiring margin amount of 1 lac at market rate and squares off that position at 1 lac (No profit no loss) still the peak margin will be 1 Lac. If customer places Buy order of Rs 1 lac margin amount and cancels this order, then Peak Margin would still be Rs.1 Lac. In both of the above cases it will remain blocked while deallocating FNO cash allocation.

If later customer places trades such that Limit utilization doesn’t increase more than Rs. 1 Lac till then Peak Margin won’t change for such orders. But if Limit utilization increases more than Rs. 1 Lac then Peak Margin amount will get increased accordingly.

Is applicable for customers who are already in the Ledger Model including NEO customers?

It is applicable to Resident Individual (RI) customers 3 in 1 Account, NRI Customers & not applicable to Running Account RI Customers. There is no change in NEO customers.

Will I be able withdraw the allocation if have not put a trade and take back to my bank account?

Yes, if you have not placed any order then withdraw funds from allocation.

How can I withdraw. Will my limits or funds get blocked or reduced?

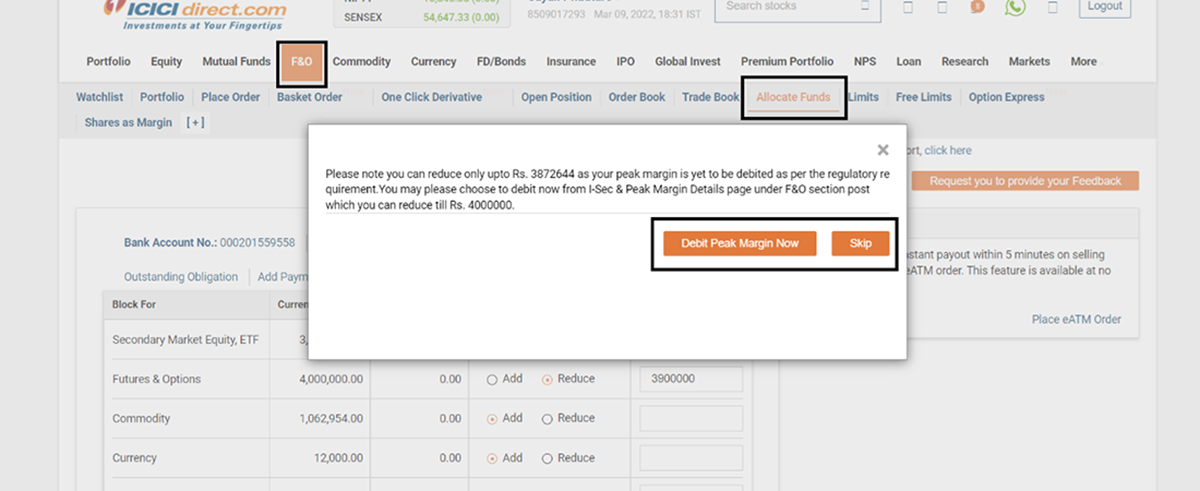

If the you are trying to deallocate the amount which falls within Peak Margin, you will not be allowed to deallocate such amount, and Peak Margin Pop Up will be displayed with option to ‘Debit the Peak Margin Now’. Once the you click on the “Debit Peak Margin Now” option, peak margin amount will be debited from FNO allocation and FNO Block For Trade balances and will be credited back to customer’s FNO allocation at the same time.

Post this, you can deallocate amount from his FNO allocation or FNO Block For Trade balances.

What is impact on deallocation of funds from F&O allocation?

If you are trying to deallocate the amount which falls within Peak Margin, you will not be allowed to deallocate such amount, and Peak Margin Pop Up will be displayed with option to Debit the Peak Margin.

What is the narration in Bank account?

Two Additional entries in the bank account Peak Margin Debit & Peak Margin Credit narration will be display in bank account.

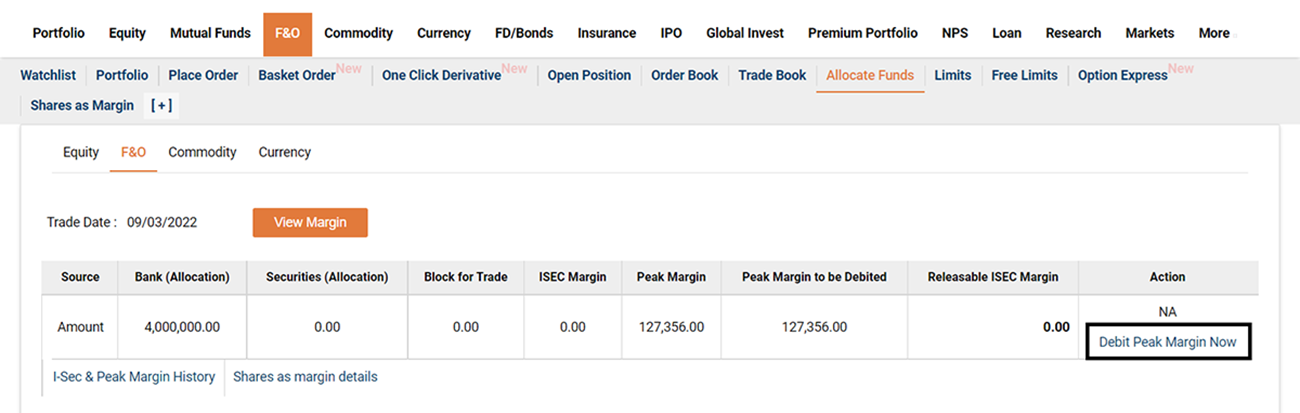

Where I can view & debit the peak margin amount?

You can view & debit the Peak Margin Amount by Path “ICICIdirect.com > F&O > I-Sec & Peak Margin Details”.

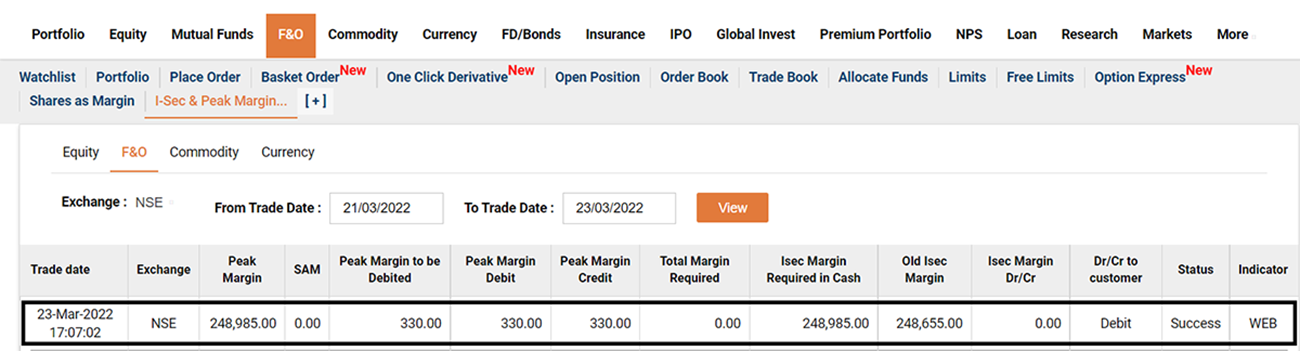

Where can client see debit & credit amount history?

Customer can see Margin Debit Credit History amount by path “ICICIdirect> F&O> I-Sec & Peak Margin History”.

Disclaimer- ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code : 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein mentioned are solely for informational/knowledge and educational purpose.

The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written coAs per regulatorynt of ICICI Securities Limited. The contents of this mail are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. While due care has been taken in preparing this mail, I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any inaccurate, delayed or incomplete information nor for any actions taken in reliance thereon. This mail is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)