What are arbitrage funds? How do they operate?

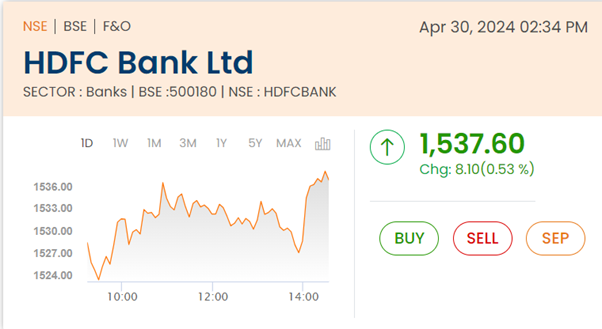

Let us show you something interesting to start with. Below is the stock price of HDFC Bank on the National Stock Exchange (NSE). What is the price - as you can see, it is Rs 1,537.60.

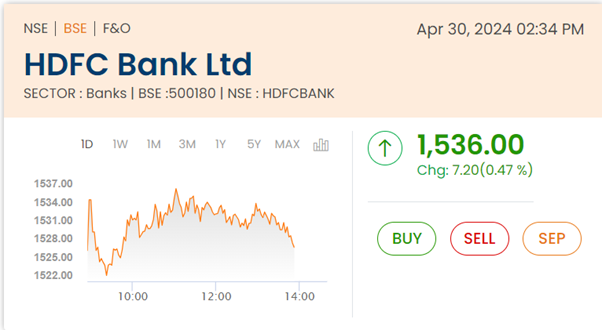

We captured the price of HDFC Bank on the Bombay Stock Exchange (BSE) at the same moment. Did you notice the difference - It is only Rs 1,536.00 - a net difference of Rs 1.6.

We repeat that both the screenshots are from the same time frame. Now, if you can buy on BSE and sell it immediately on NSE - you can make a sure shot profit, right? It would be tough for a retail investor to carry these trades, but that is what exactly arbitrage funds do - but there is more to it - this was only to explain the concept at a high level. If you are interested to know more, continue reading.

What are Arbitrage Funds?

Arbitrage funds are a type of mutual fund that aims to exploit price differentials in different markets or instruments to generate returns. The strategy involves buying and selling the same or similar securities simultaneously in different markets to profit from the price differences.

How Do Arbitrage Funds Work?

Let us take an example to help you understand how arbitrage funds work.

Part 1: Two Markets

There are two main markets involved - the cash (spot) market and the futures market. In the cash market, you buy and sell shares immediately for the current price. In the futures market, you enter a contract to buy or sell a security at a specific price on a predetermined future date.

Part 2: The Price Gap

The key for arbitrage funds is to find situations where the price of a stock in the cash market is different from its price in the futures market. Ideally, the stock should be priced a little lower in the cash market compared to the futures market.

Part 3: The Trade

The arbitrage fund manager would then do two things simultaneously:

- Buy the stock in the cash market (lower price).

- Sell an equivalent amount of futures contracts for the same stock (higher price).

The above example is a simplified version of an arbitrage fund, but it captures the essence of how they exploit price inefficiencies.

Interesting Points Related to Arbitrage Fund

Here are a few interesting points related to arbitrage funds:

Hybrid scheme for Price Discrepancies: Instead of being purely equity or debt funds, arbitrage funds act like a hybrid. They utilize the price discrepancies between markets (like cash vs futures) to generate returns, which is quite unique. This hybrid nature allows them to offer some equity-like returns with lower risk compared to traditional stock funds.

Opportunistic Equity Investment: Arbitrage funds aren't constantly invested in the equity market. They act more like opportunistic hunters. The fund manager keeps the money in low-risk, short-term debt instruments like treasury bills or commercial papers when there aren't any arbitrage opportunities. It helps them manage risk and maintain liquidity for executing trades when those opportunities arise.

Investment in Arbitrage Funds: As of March 2024, there are a total of 27 arbitrage schemes available in India with a Net AUM (Asset Under Management) of Rs 1.53 lakh crore. In FY24, arbitrage funds saw the highest inflows of Rs 90,846.11 crore.

Benefits of Investing in Arbitrage Funds

If you are still confused about whether to invest in arbitrage funds or not, let us help you better understand them by covering their advantages. Here are a few of them:

Low Risk: By simultaneously buying and selling related securities, arbitrage funds hedge their bets and minimize exposure to market fluctuations. This makes them a more stable investment compared to traditional stock funds.

Stable Returns: While the returns might not be spectacular, arbitrage funds aim to deliver consistent, positive returns by capitalizing on price discrepancies. It can be particularly appealing to investors seeking a predictable income stream. If you check some of the best arbitrage funds, you will see them delivering over 8% returns consistently.

Ideal for Volatile Markets: When the overall market is experiencing ups and downs, arbitrage opportunities can actually become more frequent. Arbitrage funds can benefit from this volatility by exploiting short-term price inefficiencies.

Tax Advantage: Arbitrage funds are categorized as equity funds for taxation purposes. It translates to better tax benefits compared to debt funds, especially for short- and long-term investments. If you are holding your investment for more than a year, you only have to pay 10% in taxes, and if the capital gain is less than a lakh, you don't pay anything.

Before you go

Arbitrage funds occupy a distinctive niche within the mutual fund landscape, leveraging sophisticated strategies to capitalize on short-term market inefficiencies. By employing arbitrage techniques across various asset classes and markets, these funds aim to deliver consistent returns with relatively low volatility. To check details of specific arbitrage funds, you can find arbitrage funds on ICICIDirect.

Source: Amfii