Unlearn these investing trends and become a better investor in 2023

If we look at a new investor journey, it will have the same elements. Let us know if these sounds similar - stock picking based on tips, investing only in smallcap companies for higher returns, investing without knowing risk profile? There is no need to feel bad about it. There are many others in the same boat as you.

There are some investing trends that most of you may be following. The downside is that you are not making good profits on your investments or even suffering losses. When the overall market is good (2020, 2021), even with bad habits, you can make returns. However, in tough times (2022 and probably 2023), you need to be cautious as an investor and do only the right things.

If you want to make the most of your financial journey, the one thing to do is to unlearn some things that you know or do.

Investing trends to unlearn

Below are some investing trends you must unlearn to become a better investor:

Chasing financial freedom early:

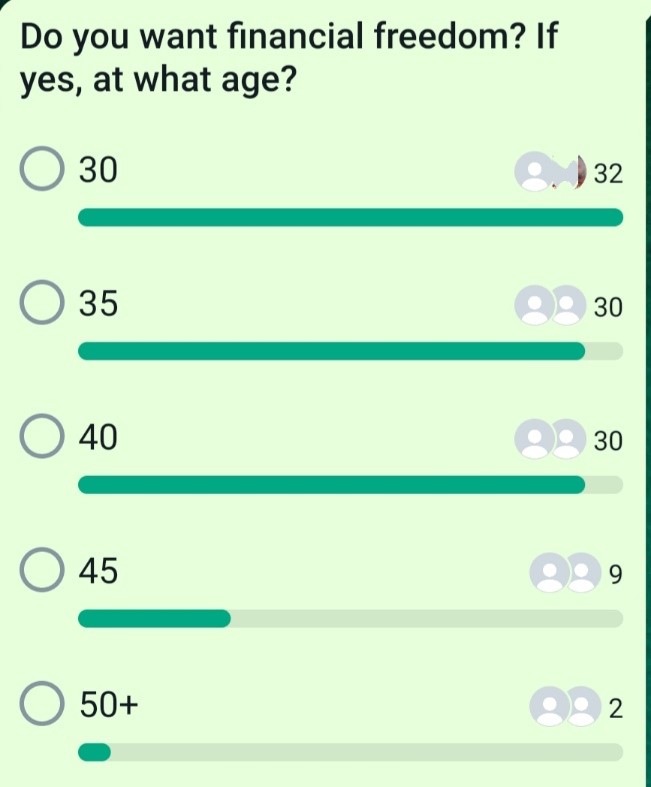

The latest buzzword in investing world today is - Financial Freedom. It seems everyone wants financial freedom, and they want it early. Today, people in their 20s want to retire at 35. They may not even understand the true meaning of financial freedom, but they are running after it because everyone is working towards it. Below is a result of a survey where the majority of users are in their 20s. More than 90% want to retire at or before 40.

The downside is that to accumulate wealth sooner, investors are taking unnecessary risks. A large part of the investment goes to small-cap and mid-cap stocks and non-regulated investment schemes that claim to offer higher returns. Investors end up losing money and unlearn this trend the hard way. Financial freedom is part of your financial journey and planning. There is no harm in desiring to retire early. However, approach it with a plan.

Running after a fad:

Following a fashion or fitness fad is good - or at least not harmful. However, if you chase a fad in investing, you are inviting trouble. You need to unlearn this trend to become a successful long-term investor.

You may have a habit of buying a stock that everyone is writing and talking about, or you may be investing in meme stocks. If you do so, the chances are you will not make money in the long term.

Another perfect example of running after a fad is new-age tech IPOs/stocks. Everyone was after them in 2021, but we have seen how they have destroyed investors' wealth post-listing.

Invest in stocks to create wealth fast:

Many investors come and invest in the stock market, but only a small percentage stay for more than three years. The prime reason for it is they come to the stock market with wrong expectations. If you come to the market thinking you will double your money every year, you may soon be disappointed with the results and leave the market.

Some companies have created wealth for investors, but to reap the benefits, you need to stay invested for a long time. Second, picking any random stock will not be helpful. You need extensive research to pick quality stocks. If you lack it, consult a financial advisor. You must have a tick in many boxes to create wealth by investing in stocks.

Timing the market is key to success:

It makes a lot of sense to time the market as a layman. Buy when the market is going down and sell when it goes up. However, the problem is in the execution. When it comes to execution, it is nearly impossible for an investor to successfully time the market. When you bring emotions to investing, the result is not so good. Second, the market 'going down' is a relative time - at what level will you time the market? The answers to these questions are difficult to give.

Investors who regularly invest in the market (via SIP) without thinking much about the daily ups and downs will benefit more. Invest regularly, stay invested, and let compounding work its magic on your portfolio.

Buy Titan share instead of a Titan watch:

The social media is filled with such information - if you had bought Titan shares in 2010 instead of a Titan watch, you would have retired as a crorepati by now. Wealth creation is a process to secure your future without disturbing your present. You cannot think about the future ruining your present life. Therefore, if you need to buy a car, buy it without too much thought to buy a share instead. Life is about creating a balance - you need to do the same with investing. Learn, save, spend, and invest.

Before you go

Investing is never easy. However, there are always ways to make it easier. There are certain things you need to do to be successful. Today, we have discussed things that you must unlearn (not do) to be successful. We hope every reader will not be doing any of the above and will become a better investor in 2023.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.