BLOG

TCS announces Rs 18,000 crore share buyback: How can Investors benefit from the opportunity?

Update (7th March 2022)

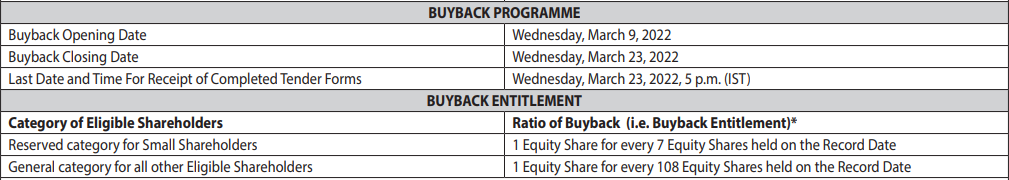

TCS tender windows will open from 9th march and closing date is 23rd march 2022

As per the “Letter of Offer” below are the acceptance ratio for small and general category Shareholders.

Source: https://www.tcs.com/events/tcs-buyback-2022

Retail Eligibility as per holding

1 share for 7- 13 shares

2 shares for 14- 20 shares

3 shares for 21- 27 shares

4 shares for 28- 34 shares

5 shares for 35- 41 shares

6 shares for 42- 48 shares

Retail entitlement ratio: 13.33%

General Category entitlement ratio: 1%

Update (15th February 2022)

TCS has fixed 23rd February, 2022, as the Record Date for defining the entitlement of Equity Shareholders who will be eligible to participate in its 18,000 crore buyback.

(Record date is the cut-off date established by a firm in order to determine which stockholders are entitled for the respective corporate action. The record date will usually be the day subsequent to the ex-date, which is the trading date on and after. To be eligible for the corporate action investors must have bought the stock at least 3 business days before the record date)

Few Important Points:

1. If you are having TCS in MTF, you need to do CTD in such a way that on ex-date shares are available in your Demat A/C.

2. If you have done SAM (Shares as Margin) in TCS, you need to de-pledge them so that on ex-date shares are available in your Demat A/C.

TCS announces Rs 18,000 crore share buyback: How can Investors benefit from the opportunity?

Tata Consultancy Services Limited board on 12th Jan, 2022 approved a proposal to buy back upto 4,00,00,000 Stocks for an amount not exceeding Rs 18,000 crore at Rs. 4,500 per share.

TCS on 12th Jan, 2022, Wednesday closed at Rs. 3857 which means that the buy-back will be executed at a premium of Rs. 643 or 16.6% from the last closing stock price.

TCS also announced a dividend of Rs 7 with record date of 20th January, 2022. TCS is India’s largest Technology company with a Market Capitalisation of nearly 14 lacs crores. The stock price of TCS is up by 30.5% in 2021.

TCS Buy-back History

If we look at the buy-back history of TCS then this is their 4th buyback since 2017 and the first by any Information Technology firm in this calendar year.

TCS had earlier approved stock buy-backs which was worth Rs 16,000 crore each in 2017, 2018 and 2020 which was a part of their long term principal allotment policy to return excess cash to shareholders.

The below table shows how the stock price has performed over last 4 buy backs:

|

Year |

Date of Buy-Back Announcement |

Price on Announcement Day |

Buy-Back Price |

Record date of Buy-Back |

Price on Buyback date |

Increase in Stock Price from date of announcement to date of Buy-back |

|

2017 |

16th February |

2400 |

2850 |

8th May |

2525 |

5% |

|

2018 |

12th June |

1746 |

2100 |

18th August |

2070 |

19% |

|

2020 |

5th October |

2523 |

3000 |

28th November |

2873 |

14% |

|

2022 |

12th January |

3859 |

4500 |

Awaited |

Awaited |

NA |

Note: Buy Back Date – The date on which investors start tendering the shares [1][2][3]

What is a Share Buyback?

A Share Buyback (also known as Share Repurchase) is when a company buys back its own outstanding shares from stakeholders to reduce number of stocks accessible in open market which is also an alternative to return money to investors.

Companies buy back stocks to increase the demand in the market, thereby inflating the stock value, Earning Per Share (EPS) and ROE of the company. A Stock buy-back is a sign the investors can use to make informed decision as it shows that the business has sufficient cash set aside for emergencies and the possibility of economic trouble is less.

What will be Acceptance Ratio and how does it matter?

Acceptance ratio is the number of shares accepted in a buyback offer as compared to the total number of shares tendered. As per SEBI rules, regulations, circulars etc. 15 % of the total buyback size is reserved for small investors with holdings up to Rs 2 lakh in the company.

There are 2 Categories - Reserved Category and General Category

Reserved Category means those investors holding Upto ₹2,00,000 shares in DEMAT. The below table depicts last time reservation vs response.

|

Category |

No. of Equity Shares Reserved in the Buy-Back |

No. of Valid applications |

Total Equity Shares Validly Tendered |

% Response |

|

Reserved Category for Small Shareholders |

80,00,000 |

1,63,364 |

61,25,386 |

76.57% |

|

General Category for all other Equity Shareholders |

4,53,33,333 |

32,106 |

14,02,87,605 |

309.46% |

How can I benefit from TCS buy-back offer?

The simplest thing is to buy TCS is from a long term perspective. It is the largest Tech Stock in India. TCS has been a wealth creator for multiple decades.

TCS Q3 results were above our estimates on revenue front. In terms of revenue by geographies (in CC terms), North America market (52% of mix), grew by +18.0% YoY, while UK and Continental Europe reported healthy growth of +12.7% and 17.5% YoY respectively.

The demand outlook continues to be strong as clients are accelerating their spending on cloud transformation and new technologies to remain ahead of the curve. Watch out for our earnings update on ICICIdirect here at https://www.icicidirect.com/research/equity/investing-ideas

Can I buy TCS under Margin Trading Facility (MTF) to benefit & tender shares at Rs 4500 per share?

You can buy the Stock under Margin Trading Facility with ICICIdirect and take delivery of stocks before the Buy-back date to tender your shares and record date for eligibility. You can book profit anytime in-between as well.

The thing to be aware about while using the Margin Trading Facility is the funding cost. ICICIdirect offers Margin Funding at amongst the lowest in market with upto 7.9% P.A.

The funding cost depends upon the number of days its takes for the process to be completed. The average number of days in last Buy-back from date of announcement to Date of tendering in buy-back is approximately 80 days. If you are looking at funding Option, the cost of funding with prevailing ICICIdirect Margin Funding Interest rates will be approximately 1.7% considering past time frames. The dividends will be credited to your account which will reduce the cost.

What are the key things to note before looking at Options like Margin Trading Facility (MTF) to buy TCS?

Here are the top factors which are very important.

- Acceptance Ratio: The tendering of shares will depend upon the acceptance ratio and this is very important. For category less than 2 lacs, there is reservation of 15% of the issue and acceptance ratio generally here are higher.

- Bringing cash to take delivery: If you have taken funding to buy the stock, your shares will be pledged as per SEBI guidelines of Margin Trading Facility. Before the tendering date as well as Record date, you would need to bring the cash in your account to take delivery of the shares. Only Free shares can be tendered.

- Price Volatility: During buy back process, there can be volatility in stock prices and if you have taken funding on the Stock and you will be required to ensure that you always have minimum margins available.

Read more about Margin Funding at ICICIdirect here.

Will I get benefits of dividend if I buy TCS shares under Margin Trading Facility

Yes, you will get dividend even if shares are pledged with ICICIdirect under MTF.

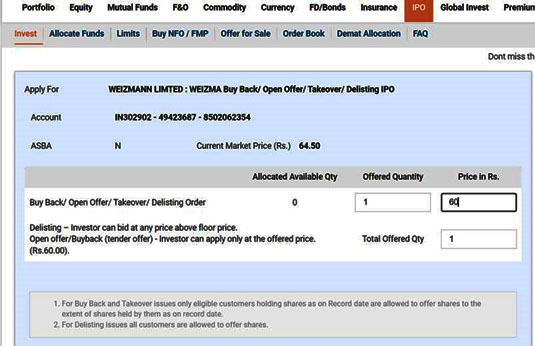

How do I tender my share under buy-back online on ICICIdirect?

Tendering shares for Buy-Back is very simple on ICICIdirect. It’s completely online and just few clicks. Just visit www.icicidirect.com , click on IPO / Buy Back, enter the number of shares you wish you tender and you are done. Our systems will automatically block and tender your shares and credit the money in your accounts as eligible.

FAQs on Buyback 2022

1. What is the Buyback Offer size?

The Buyback Offer size in terms of Equity Shares to be bought back, will be 4,00,00,000 (Four crore) Equity Shares and in terms amount will be approximately Rs. 18,000 Crores, which represents 1.08% of the total issued and paid-up equity share capital of the Company, as on December 31, 2021.

2. How many shares will the Company buy back?

The Company will buy back up to 4,00,00,000 (Four crore) Equity Shares

3. What is the Buyback Offer Price?

The Equity Shares will be bought back at a price of ₹ 4,500 (Rupees Four thousand Five Hundred only) per Equity Share.

4. What is the Record Date?

Record Date for the Buyback is Wednesday, February 23, 2022, for determining the Buyback Entitlement and the eligibility of the shareholders to participate in this Buyback.

5. If the Record Date is February 23, 2022, can I buy Equity Shares of this company on February 22, 2022 to be eligible for this Buyback?

Any purchase or buy order is completed on T+2 days (excluding any Saturday, Sunday and public holidays), where T is the day on which you place the order. If you buy Equity Shares on February 22, 2022, you will not be able to participate in the Buyback, as you will not be a shareholder of the Company as on the Record Date.

6. Record Date is announced; I have not received the application form. When will I receive the form?

The Letter of Offer along with Tender Form will be sent to the Eligible Shareholders on or before the Buyback Opening Date either via Email or Registered Post / Speed Post / Courier. An Eligible Shareholder may participate in the Buyback by downloading the Tender Form from the websites of the Company, Registrar to the Buyback and Manager to the Buyback at https://www.tcs.com/events/tcs-buyback2022 , www.linkintime.co.in and www.jmfl.com respectively

7. My address is changed now and I want my offer document to be posted to my new address and not the old address?

In case you hold Equity Shares in dematerialised form, you may send a request in writing to the Company or Registrar at the address or e-mail id mentioned at the cover page of the Letter of Offer stating name, address, number of Equity Shares held on Record Date, client ID number, DP name / ID, beneficiary account number, and upon receipt of such request, a physical copy of the Letter of Offer shall be provided to you. In case you hold Equity Shares in physical form, you may send a request by providing application in writing on a plain paper signed by all Eligible Shareholders (in case of joint holding) stating name, address, folio number, number of Equity Shares held, equity share certificate number, number of Equity Shares tendered for the Buyback and the distinctive numbers thereof, enclosing the original Equity Share certificate(s), copy of Eligible Shareholder’s PAN card(s) and executed share transfer form in favour of the Company. Please be informed that this new address will not be updated in the records of the Company and if you need this to be updated then please write to TSR Darashaw Consultants Private Limited (RTA of the company).

8. Who is appointed as the Company’s broker?

JM Financial Services Limited is appointed as the Company’s broker for the Buyback.

9. What is the mode of Buyback implementation?

This Buyback offer will be implemented through “Tender Offer” route through the stock exchange mechanism, in terms of the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018, as amended from time to time.

10. I read this Buyback is via “Tender offer”. What is that? What do you mean by “Tender offer”?

As per Regulation 2(1)(q) of the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018 ‘tender offer’ means an offer by a company to buy back its own shares or other specified securities through a letter of offer from the holders of the shares or other specified securities of the company. In a “Tender offer” process, a shareholder will have to approach his selling member (stock broker) registered with the exchanges. For the buy back, the shareholder has to approach the selling member registered with BSE for tendering the shares, through the selling member (broker), using the Acquisition Window of the Designated Stock Exchange. This process is similar to the secondary market mechanism.

Sources:

[1] https://www.tcs.com/investor-relations

[2] https://www.nseindia.com/get-quotes/equity?symbol=TCS

[3] https://www.tcs.com/events/tcs-buyback-2020

Disclaimer:

ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No:- 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code:-07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. SEBI research analyst Registration no.-INH000000990. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Invest

Invest

Blogs

Blogs

Video

Video  Podcasts

Podcasts