Get access to convenient platforms & features, like

✓ Flash Trade for clutter free trading

✓ GTT orders to track the market

✓ eATM to receive money within 5 minutes of selling stocks*

✓ Margin Trading Funding (MTF) to buy stocks now and pay later

✓ Payout analyzer & other tools, resources, research & live market commentary you need to stay on top of the stock market

…that too, at preferential prices with brokerage plans like ICICIdirect Prime So why wait?

* 75% of the amount

Open an account today!Get access to convenient features like

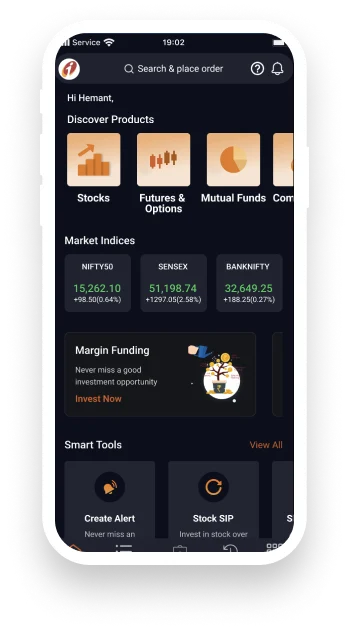

✓ Stock SIP - SIP in individual Stocks /ETFs

✓ One Click Equity- More than 40 theme based portfolios are available

✓ One Click Mutual funds & more

So why wait?

Open an account today!

Get experts to manage your wealth with

ICICI Securities Private Wealth Management –

where senior private bankers manage over

₹ 3.7 lakh crore in assets for more than 91,000 Customers

Live the AND life with products to suit your requirements, that too at your doorstep. Choose your product & provide your details online, our representative will get in touch with you for further processing!

Explore More

Get started on your investment journey with our diverse and easy to use range of products and features

Start an SIP in individual Stocks/ETFs and invest in a disciplined manner

Simplified chart-based F&O trading with Up/Down buttons - a single screen to track, trade & exit

More than 40 theme based portfolios are available

Choose from a range of readymade research backed trading strategies

Readymade Investment packs of Mutual Funds

Advanced tools and features to help you trade online in all key segments - Stocks, Futures & Options, Commodities & Currencies

Benefit from daily price movements of the stock

Generate 100% trading limits for your pledged shares, at 0% interest (*Scrip wise haircut shall be applicable, Interest of 0.025%/day on carry forward positions of Neo customers)

Eliminate the need of monitoring market continuosly

Precisely timed auto slices of your large orders, no more worries of market volatility

Buy stocks now and pay later with MTF

Rule based automated buying & selling of contracts. Just sit back and relax while the system trades for you

Add upto 50 different contracts in a single basket and place all in a single click. Even upload your own strategy in csv format

Build, check and trade your strategies in live markets using free to use APIs. Experience zero brokerage on F&O trades

Online trading and investing in the market does not have to be boring

Place a three-legged F&O order with buy/sell, target, and stoploss at once. Order stays valid until expiry of contract

Explore expected payoff levels for your F&O strategies at different market levels and scenarios

Stay updated about your portfolio and Stocks at all times.

Receive money within 5 minutes of selling stocks

Designed to deliver customized wealth solutions to cater all financial needs

✓ Stocks, Mutual Funds, F&O, IPO, Commodity, Currency, FD & Bonds, Insurance, Global Invest

✓ One stop destination for Trading & Investment Ideas

✓ Tools that makes trading and investing easy