Learning Modules Hide

Hide

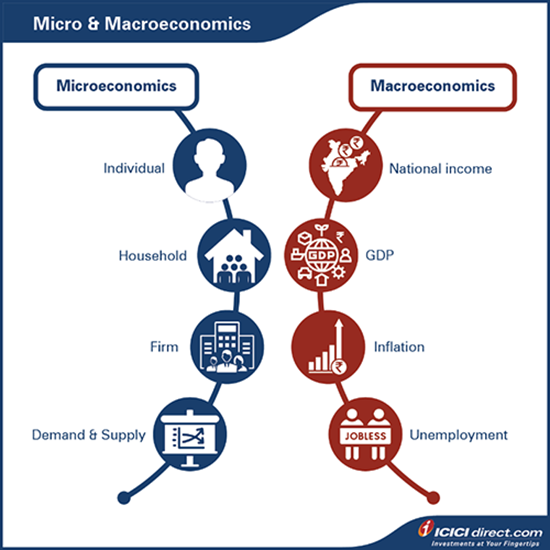

Chapter 7 - Micro and Macro Dynamics of the Stock Market

You marvel at the incredible pictures that your friend took of his recent Switzerland tour. In the background in one of his skiing tours you notice a familiar peak.

You squint hard at the image and wonder if it's the famous Alpine Matterhorn.

It appears familiar, and so to get a closer look, what do you do?

That’s right. You ZOOM IN.

And when you want to view the picture in its entirety, you obviously ZOOM OUT.

So, in economics… wait, what’s that now? Why study economics?

That’s because studying economics may help you understand the potential ramifications of economic policies on various industries. It is a tool that may help you predict macroeconomic conditions and realise the implications of those predictions on businesses, stocks, and financial markets.

Now, when it comes to studying economics of a country, the ZOOMED-IN version is called as microeconomics and the ZOOMED-OUT version is called as macroeconomics.

Now, let’s understand what they are.

Microeconomics

Microeconomics focuses on the study of decisions taken by individuals, businesses, households, workers and so on.

Let’s understand this with an example:

Say, you have been driving your car to work every day. But of late, the increasing price of petrol has begun to worry you.

You wonder if carpooling may be a good idea. You speak to a couple of your colleagues living in your vicinity. And they gladly welcome your idea of carpooling.

The decision of carpooling was made and agreed due to the exponential patrol price hike.

The study of how specific changes in commodity prices can lead to an individual or business changing their action is known as microeconomics.

Did you know?

The term ‘micro’ comes from Greek word ‘mikrós’ which means ‘small’.

Macroeconomics

Microeconomics, on the other hand, deals with issues like inflation, growth, inter-country trades, unemployment and so on.

Did you know?

The term ‘macro’ comes from Greek word ‘makrós’ which means ‘large’.

Microeconomics and macroeconomics are complementary to each other.

Microeconomics is similar to a bottom-up approach, where individuals and businesses are first analyzed followed by an industry and eventually the country.

Macroeconomics is more like a top-down approach, where the country is first analyzed, subsequently the industry and finally individuals or businesses. Macroeconomics factors play a vital role on stock market growth and performance.

What are the factors that macroeconomics concentrates on?

Well, it focusses more on factors such as Gross Domestic Product (GDP), unemployment rate, inflation, interest rate, government debt, business cycles and so on.

But how does this affect the stock market?

Let’s summarize the impact of these factors with the following table:

|

Economic factors |

Impact on Equity |

|

Rise in inflation |

Bad |

|

Rise in GDP |

Good |

|

Rise in unemployment rate |

Bad |

|

Rise in interest rate |

Bad |

|

Rise in government debt |

Bad |

|

Business cycles - Boom phase and recovery phase |

Good |

Also Read: Chapter 10: Economics for Stock Market

Summary

- Microeconomics focuses on the study of decisions taken by individuals, businesses, households, workers and so on.

- Macroeconomics focuses on issues like inflation, growth, inter-country trades, and so on.

In the following chapters, we will cover the mentioned economic factors and how they impact the equity market.

Invest

Invest

COMMENT (0)