Learning Modules Hide

Hide

Chapter 10: Introduction to Initial Public Offer (IPO)

You must have heard these phrases before -

‘The early bird catches the worm.’

‘Better to start early than to finish late.’

‘First come, first served.’

‘A day late and a dollar short.’

And many more that emphasizes the first-mover advantage. An Initial Public Offer (IPO) intends to offer you the same by giving you an opportunity to buy shares of a company when it is offered to the public for the first time and at an attractive price.

Both new and seasoned investors eagerly look out for IPOs to make in their bid and hope to get a piece of an upcoming and new business.

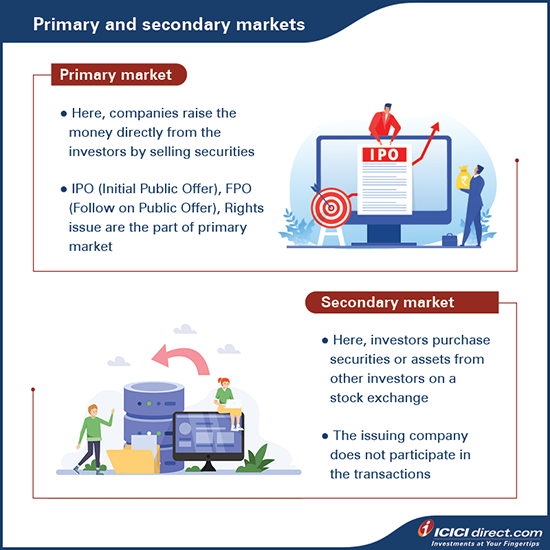

Primary and secondary market

But, before we understand everything about IPOs, we need to know something about primary and secondary markets.

A primary market is one where a company raises money directly from investors by selling securities. When the company raises the money for the first time from investors by selling their shares, it is known as Initial Public Offer (IPO).

Primary market

While the secondary market is where all securities are traded once the company has completed its IPO on the primary market. The secondary market is simply known as the stock market. Here, the activity takes place directly between investors, and so the issuer is not involved. These transactions generally take place on the stock exchange.

Secondary market

Why are both primary and secondary markets needed?

One way to think of the importance of both these markets is they are like two sides of the same coin. They move independently; they also rely on one another. The money that comes in from a primary market allows for growth of the company. The liquidity that a secondary market provides gives flexibility and stability.

Now we come to the subject of IPOs.

What is an Initial Public Offer (IPO)?

You may have heard the expression "going public". This term means that it is the first entry of a company into the public stock market through an IPO. An initial public offering allows the company to raise money by offering investors shares of their private company and listing on the stock exchange. The company that offers its shares through the public issue is regarded as an 'issuer'.

The company may sell the shares from existing investors, including promoters, or issue new shares in the IPO.

Once the IPO ends, the company's shares are listed on the stock exchange and can be further traded by investors.

Let us understand it with an example:

Karan owns a chain of electronic shop ‘The Gadget Universe’ which is quite profitable. He's got a decent number of loyal customers. He now feels the need to expand his business to enable people from across the country and even abroad to know more about the unique collection he sells.

But he doesn't have the money in hand. At the same time, he doesn't want to go into debt.

So, what does he do?

He contacts a local investment bank to lead the IPO process and act as the underwriter. He lets them know why his company - The Gadget Universe has the potential to grow. Based on the information and numbers provided, the bank values his company. They discover that the valuation of his business is Rs. 400 crore. At present, Karan and his family members own a 100% stake, i.e., all the four crore shares of the face value of Rs. 10. Investment bank advice Karan that his company should dilute his stake by 25% by selling one crore share at Rs. 100 per share. This will dilute Karan’s stake by 25% and allocates the same to the public at an issue price of Rs. 100 per share to raise 100 crore. This means every investor will pay a premium of Rs. 90 on a face value of Rs. 10. While Karan owns 75% stake i.e. 3 crore shares which would be worth Rs. 300 crore.

So, what next?

Next, they prepare a draft prospectus, known as Red Herring Prospectus (RHP). DRHP has all the necessary details related to company, its promoters and IPO. This step is compulsory as it ensures all the essential documents are disclosed, which is later vetted and approved by the market regulator, SEBI.

This is followed by preparing and submitting an application to the stock exchange to release its initial issue.

Stay tuned as we explore the IPO process in detail in the following chapters.

So, what happens when the IPO is opened?

Along with the underwriter, the company determines the number of shares to be allotted to each investor. As per the above example, ‘The Gadget Universe’ now has Rs. 100 crore to expand his business and develop an online presence. Since then, Karan has launched his electronics brand across eight cities and has become more productive than before.

What are the benefits of going public?

An IPO is not just an indication that a private company requires funds to boost its growth. It is also a sign that the business has made its mark on the world map.

To simplify, the benefits include -

- Offers capital-raising opportunities or may help pay off expenses and debt

- Expands the investor base

- Generates credible publicity

- Provides exit strategies to the company founders and other investors

- Provides liquidity for investors

Did you know?

The biggest IPO in India was that of One 97 Communications Limited (Paytm)'s Rs. 18,300-crore issue, listed in November 2021.

* as of November 2021

What are the different types of IPOs?

IPOs also come in two types - Book building and fixed-price issue.

The main area of difference between both IPOs is the price offered to investors.

- In book building issues, there is a price band available. As an investor, you can bid at any rate between the price bands.

- In fixed-price issues, investors need to apply at that one price only.

Typically, most IPOs you see in the market are book building ones.

Let's look at an example to understand the book building IPO type

Soft Plastics is offering three crore shares in the price band of Rs. 105-110. The lower price band is Rs. 105; similarly, the upper price band is Rs. 110. Now, as an investor, you can bid for this IPO in the range of Rs. 105-110.

Depending on the applications, the company will decide the issue price for the IPO to be subscribed completely. In the event of over-subscription, investors are allotted based on pro-rata.

On the other hand, if Soft Plastics is highly subscribed, allotment could be given on a lottery basis. So that means, if an investor has bid below the issue price, they may not receive any shares. And those investors who applied at a higher rate than the issue price will only be allotted shares at the issue price.

So, as a retail investor, if you are not able to understand the correct IPO price, what do you do?

There is an option called the cutoff price.

A cutoff price means applying for shares at an issue price without having to bid at a specific value. When you bid at cutoff, you ensure that your application will be part of the allotment process and get the shares at the issue price decided by the company, if allotted. However, you need to pay the amount as per the upper price band at the time of the IPO application. If a company decided to issue shares lower than the upper band, you would get a refund of the differential amount

Additional Read: How to track upcoming initial public offerings (IPOs)

Summary

- The stock market comprises two types — primary market where the company sells stocks directly to the investors; secondary market where all securities are traded.

- An Initial Public Offering (IPO) is the first entry of a company into the stock market, where it raises money by selling its shares to the public for the first time.

- To apply for shares at an issue price without having to bid at a specific value, you can opt for the cutoff price.

Now that you are acquainted with an IPO and its types, let's look at the different kinds of investors who can invest in an IPO in the following chapter.

Disclaimer -

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. Please note, IPO related services are not Exchange traded products and I-Sec is acting as a distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)