Learning Modules Hide

Hide

Chapter 1: Orientation on Option Strategies

Introduction

Trading essentially means buying and selling goods and the idea is to maximize profits with minimum risks. It can be safely said that this has also been the palpable objective of every individual investing in the markets. In this context, Options offer the trader the opportunity to multiply their investments in the shortest span of time. However, these financial instruments come with a caveat – that of being extremely risky. Naked short Options could be extremely hazardous if your judgement of the movement of the underlying asset goes wrong.

Theoretically, buying an Option carry a limited amount of risk and unlimited profit opportunity, but in the practical scenario, many traders may lose this 'limited amount,' and unlimited profit will be realized only by a few when the market move unexpectedly in one direction.

The obvious question that arises here is that given this scenario, why do so many traders continue to trade in Options, and that too on a large scale? The answer is ‘human psychology, more specifically the ‘Gambler's fallacy’. Also known as the ‘Monte Carlo fallacy’, this is the erroneous thought process that believes that the likelihood of an event taking place is dependent on the occurrence of a previous sequence of events. That is, people believe that after experiencing a series of loss-making events, the tide will turn in their favour, and they will witness a sequence of profit-making trades.

This is like what one experiences in a casino. There, after every loss, one thinks that I now understand the ongoing pattern, and the next event will be in my favour.

However, no pattern exists. It’s like flipping a coin five times, and each time the head lands face up. That gets you thinking that the probability of tails landing face up will be high the sixth time that the coin is tossed. However, there is a 50% probability that either head or tails will land face up. This is because the outcome of future events does not depend on what occurs in the past.

It is important to break the chain of this type of behaviour by thinking and acting rationally. Weigh the probability of all possible outcomes carefully before commencing Options trading. That is, understand the chances of risk and reward before taking any position.

One of the best ways to trade in Options is to deal in Option strategies, instead of naked Options. Option strategies help you to lower your risk and protect your gains. However, few strategies can lead to unlimited losses. So, along with being cautious while dealing with Options, it is important to understand the nitty-gritty of these strategies. The idea in doing this is not to create fear but instil caution in your mind to trade in Options profitably.

Key points to trade in Option strategies

A few things should be kept in mind while trading in Option strategies:

- Predict the market outlook correctly: It is essential to estimate the market’s direction before taking any position. There are strategies for every type of market movement, direction, and volatility. Be sure that you identify the trend and other parameters correctly.

- Don't try to overleverage: Whenever you are taking a short position in Options, be aware of your net exposure. Your risk is measured on the exposure taken, not on the margin you pay.

- Keep an exit plan in place: Whenever you trade in Options, pre-decide your exit points. It is also equally important to define exit points in case your trade results in losses.

- Avoid trading in illiquid Options: Many Options, which are deep in-the-money (ITM) or deep out-of-the-money (OTM), are illiquid. It means that buying and selling of these Options may be difficult at an opportune time.

- Buy all the legs simultaneously: Many traders do not buy all the legs simultaneously to reduce costs. However, is it worth taking that risk? The answer is no. The cost saving of buying an Option at a low price or selling at a high price is not worthwhile as compared to the risk present in the naked Options.

Additional Read: Why Liquidity Matters to an Options Trader?

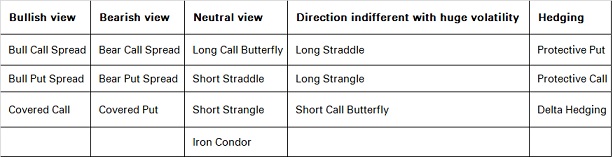

List of Option strategies

There are hundreds of Option strategies that exist in the market. While it is not necessary to understand them all, your knowledge of the strategies you know should be thorough.

In this module, we will discuss the following strategies that are used in different market scenarios. We will discuss one strategy in each chapter and show the payoff of each leg in these scenarios. Our objective is to simplify them and help you identify the risk and reward of each ratio. However, it is essential to know the basics of the Options first before you proceed further in this module. You can refer to our module on Options Trading to get an understanding of the Options.

Summary

- Option strategies are considered better in comparison to the naked Options.

- It is essential to think and act rationally while trading in Option strategies.

- Do not over-leverage and always have an exit plan in mind.

We will now discuss the strategies that are used in different market scenarios. Each strategy will be detailed in a single chapter. So, let’s get started!

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)