Learning Modules Hide

Hide

Chapter 7 : Basics of Debt Mutual Funds (Part 1)

Gaurav is a young IT professional who wants to invest a portion of his savings in mutual funds. His friends often talk about debt mutual funds as a safer option when compared to equity mutual funds. They use a lot of jargon like coupon rate and G-Sec that leaves him confused.

Have you ever found yourself in a similar situation? Don’t worry, we’ve got you covered.

To understand debt mutual funds, you need to get a hang of some jargon, or regularly-used terms, when it comes to the debt market. Not only will you be able to follow dinner conversations about debt mutual funds, they will also help you understand the nuances of debt mutual funds better.

Basic Terms Related to Debt Markets You Should Know:

Fixed-Income Securities:

Fixed-income securities are instruments that provide investors a fixed return periodically along with the principal invested. A government, corporation or any other entity looking to raise funds can issue a fixed-income security. They are sort of like loans and when you purchase one of these instruments, you become the lender. You get paid a fixed interest in return for the money you invest. Fixed income securities include bonds, debentures, money market securities, G-Secs, etc.

Bond:

A bond is a type of long-term fixed-income instrument that can be issued by companies, governments or municipalities to raise funds for a project or operation. You will receive a fixed interest on your investment. Most often, bonds are secured instruments, meaning, they are backed by an asset. The risk of not receiving your invested money is much lower than equity instruments.

Debentures:

A debenture is another fixed-income security just like bonds. It pays a fixed interest at regular intervals. The can be secured or unsecured and are most often issued by companies.

Money Market Securities:

Money market securities are short-term fixed-income instruments that typically have a maturity period of less than a year.

G-Sec/Gilt Securities :

These are fixed-income securities issued exclusively by the government. The default risk involved in investing in G-Secs is considered zero or negligible because it is backed by the government.

Treasury Bills:

Government-issued debt securities with a maturity period of less than a year are called treasury bills.

Did you know?

- The fixed-income or debt market is the oldest securities market in the world.

- The debt market is the largest financial market in the world in terms of value and volume. It is even bigger than the equity markets!

Maturity Date:

This is the date on which the investors must get back their maturity amount, i.e. principal, along with interest. The maturity date for fixed-income securities is declared at issuance and does not change after that.

Time To Maturity:

It is the period after which the debt security matures and as you move closer to the maturity date, the time to maturity reduces.

Let’s understand the difference between the two with an example:

A 10-year government bond matures in 10 years. The maturity date for the same is set at issue and remains unchanged. The bond holder would receive the principal amount along with the interest once the bond matures. However, the time to maturity reflects the period from the present moment to the set maturity date. This means the time to maturity will reduce as one moves closer to the maturity date.

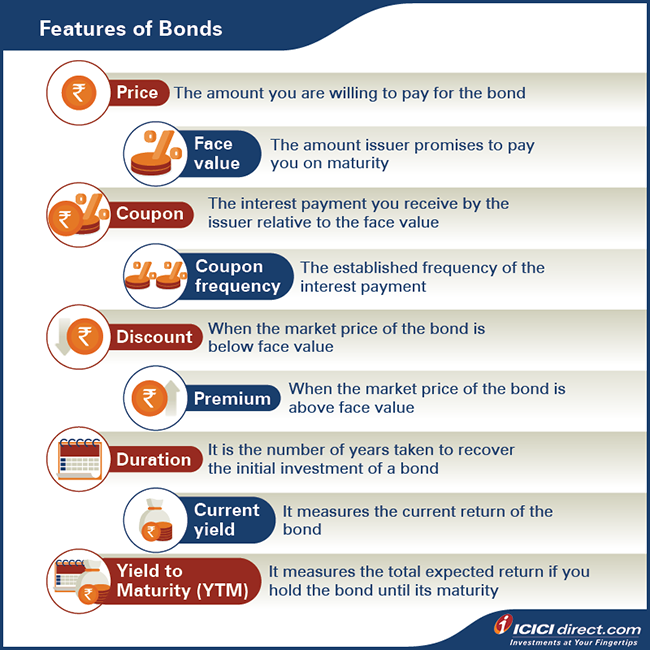

Face Value :

This is the amount of money that a debt security issuer promises to pay an investor on maturity. This is different from the price of a debt instrument. Face value is also called maturity value or par value.

Price :

Just like equities, fixed income securities are also tradable. Price refers to the current market value or the amount someone is willing to pay for the instrument.

Coupon :

The interest paid for a debt instrument is called the coupon rate. It is calculated based on the face value of a security. For instance, a debt security with a face value of Rs. 1,000 with an annual coupon rate of 6% means that it will pay Rs. 1000*6/100 = Rs. 60 as an annual coupon. This coupon rate will remain fixed irrespective of the changes in the interest rate in the market.

Coupon Frequency :

This refers to how frequently the interest or coupon amount is paid. A semi-annual coupon means interest is paid twice a year and the coupon frequency is two.

Discount :

When a debt security’s price is below its face value, it is said to trade at a discount.

Premium :

When a debt security trades at a price higher than its face value, it is said to trade at a premium.

Duration :

Duration of a debt security is different from its maturity period. At this point, all you need to know is that duration refers to the time a security takes to recover its initial investment amount. It is also called Macaulay Duration. More on this later.

Current Yield :

Current yield measures the current return of a debt security. It is different from the coupon rate in the sense that it compares the annual coupon amount to the current market price of the security.

Yield to Maturity (YTM):

This measures the total return you can expect if you hold the debt security until its maturity. It is considered a long-term bond yield but expressed as an annual rate. Often, it is also called the internal rate of return (IRR). YTM factors in the present values of all future cash flows from the investment that equate to the current market price. Here is the formula to calculate YTM:

Where

C = Coupon payment

r = Annual discount rate or YTM

MV = Maturity value

n = Years to maturity

Once you understand these terms, you are good to go! If you ever find Gaurav lost at a dinner table conversation, give him this handy guide!

Credit Rating :

Bonds are assigned credit ratings which represents the credit-worthiness of the bond. It represents how likely the company is to repay the invested amount and interest to investors. There are special credit-rating agencies that assign ratings. AAA bonds are highest-rated, meaning they are most likely to repay the invested money and interest on time. Junk bonds carry higher risk. We will dive deeper into this in the upcoming chapters.

Summary

- A fixed-income or debt security is an instrument that provides investors a fixed return periodically along with the principal invested.

- Bonds, debentures, G-Secs, money market securities are examples of debt securities.

- Face value is the amount of money promised to an investor on maturity while price is the current market value of the instrument.

- Coupon rate is the interest paid for a debt instrument. Current yield measures the current return of a debt security while yield to maturity measures the total return if you hold the security until maturity.

- Bonds are assigned credit ratings which represents the credit-worthiness of the bond. It represents how likely the company is to repay the invested amount and interest to investors.

You’ve got the basics under your belt. In the next chapter, we will delve deeper into debt instruments, and how debt mutual funds generate returns.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)