Learning Modules Hide

Hide

Chapter 3: Futures and Forwards: Know the basics – Part 2

Risks of Forward contracts

Although Forward contracts are expected within the business fraternity, they come with certain risks. Here are some of the common threats that buyers and sellers could face:

Liquidity risk

To enter into a Forward contract, you need a counterparty who holds the opposite view to yours. Finding such a counterparty is not always easy in the real market.

In the example above, Seema and Anant took out the contract because they held opposite views. Seema expected the tomato price to rise while Anant expected it to fall. What if both parties had expected the price to either rise or fall? No Forward contract would have been possible then.

Taking a position becomes difficult if there aren’t enough participants in the market. Sometimes, you may need a third party or an intermediary to help you find a suitable counterparty. The third-party would charge a fee for this service.

Default risk

Also known as credit risk, this is one of the most significant risks for Forward contracts.

Imagine a scenario where the price of tomatoes falls to Rs 6/kg. Thanks to the Forward contract, this should bring hefty profits to Anant. But Seema might decide not to honour the contract terms because of the loss she would incur. If she defaults, Anant will lose out.

Forward contracts are risky as no payment is exchanged when the contract is initiated. Also, in the absence of day-to-day financial settlements, the risk further increases. So, this remains a risk to both parties.

Regulatory risk

Forward contracts require only the mutual consent of the buyer and the seller. There is no regulator involved. The absence of a regulator makes it challenging to recover the money if one party defaults on the contract.

In Futures, on the other hand, this regulatory risk is minimised. The trades are regulated by an exchange that has safeguards to mitigate default risk by either party.

Lack of flexibility

Forwards can be highly personalised as the contracts are directly between buyer and seller. But once the contracts are drawn up, they don’t offer much flexibility. They have to be executed on the defined expiry date. Buyer and seller may not have the option to exit the contract before expiry.

Should a party wish to close their position, they would need to find another party who will take their place. Owing to the liquidity risk, finding a party to take over the contract for the remaining period can be challenging.

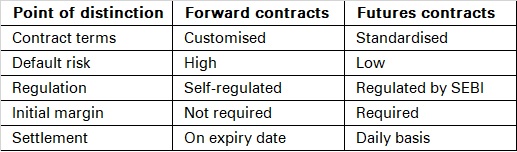

Differences between Forwards and Futures

Although Forward and Futures contracts are similar, there are some critical differences between them:

-

Contract terms

Forward contracts are based on the mutual consent of the buyer and the seller. So, traders can customise them. On the other hand, Futures contracts follow the rules and regulations of the exchange on which they are traded. That makes them more standardised.

-

Default risk

The exchange has several safeguards in place to reduce the risk of default on Futures. But there is no regulatory intervention in a Forward contract. With Forwards, the risk of a party not honouring the contract terms is high.

-

Regulation

The exchange on which the Futures contract is traded regulates its terms as well as the transaction. But the Forwards market operates without such a regulator. Parties usually enter into Forwards contracts on their own.

-

Initial margin

Futures contracts require a margin payment in advance by both parties. That ensures that both buyer and seller are make a financial commitment towards the contract, which brings down the risk of default. A Forward contract requires no such initial margin, and credit risk remains high as a result.

-

Settlement

Forward contracts are settled only on the pre-agreed expiry date. Futures, on the other hand, can be settled at any time before the contract’s expiration. Besides, finding new counterparties to a Futures contract is easy given its high-liquidity through the exchange.

Derivative instruments in India

There are two kinds of derivatives available for trading on the National Stock Exchange (NSE) and the BSE (formerly the Bombay Stock Exchange). These are Futures and Options.

- A Futures contract is a standardised contract between two participants to buy or sell an underlying asset at a particular future date at a specific price.

- An Options contract is slightly different. It gives one party the option to either execute the contract or not by a particular future date and at a specific price.

You now have a basic idea of the trade-in derivatives. The following chapters will discuss how these derivatives instruments work.

Summary

- Risks involved while trading in Forwards Include, liquidity risk, default risk, regulatory risk and lack of flexibility.

- The main areas of differences between Forwards and Futures lie in their contract terms, their default risk, regulation, initial margin and settlement.

- In India, there are two kinds of derivatives to trade on the NSE and the BSE — Futures and Options.

Part 2 of Futures and Forwards Contracts ends with this chapter. In the next chapter, we dive deeper into Futures to get an in-depth view.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)