Learning Modules Hide

Hide

Chapter 3: A Beginners Guide for Stock Market Basics

Stock market participants and regulator

Market participants

Market participants are essential for the smooth functioning of the market and provide a link between buyers and sellers of securities in the securities markets. These entities are also known as Market Intermediaries. It is mandatory for these intermediaries to get themselves registered with the regulator, i.e. SEBI. These market participants may get registered with SEBI in different roles like Stock Exchanges, Depositories, Depository Participants (DP), Stock Brokers, Registrars and Transfer Agents (RTA), Merchant Bankers, Clearing Corporation, etc. Some of the major participants and their roles and functions are mentioned below:

Stock exchanges

The stock exchanges provide a trading platform where buyers and sellers (investors) can transact electronically in securities. Earlier, these transactions used to take place physically by meeting in person in the stock exchange through an ‘Open Cry’ system.

But in today’s time, trading takes place online through computers connected to the Internet.

Depositories

The organization responsible for maintaining investors’ securities in electronic form is called the depository. In other words, a depository can therefore be conceived of as a ‘bank’ for securities. In India, there are two such organizations viz. NSDL and CDSL. The depository concept is similar to the banking system with the exception that banks handle funds whereas a depository handles securities of investors. An investor wishing to utilize the services offered by a depository has to open an account with the depository through a Depository Participant.

Depository participants

The market intermediary through whom depository services can be availed by investors is called a Depository Participant (DP). As per SEBI regulations, DPs can be organizations involved in the business of providing financial services like banks, brokers, custodians and financial institutions. This system of using the existing distribution channel (mainly constituting DPs) helps the depository reach a wide cross-section of investors spread across a large geographical area at a minimal cost.

Trading members or stock brokers

A trading member or a stock broker is a member of a stock exchange and can provide securities trading facilities to investors. Trading members can be individuals (sole proprietors), partnership firms, corporates and banks, who are permitted to become trading and clearing members of recognized stock exchanges, subject to fulfillment of eligibility criteria. Stock brokers can be associated with multiple stock exchanges to provide trading services to investors. Investors need to open a trading account with a stock broker to invest in stock markets. Investors cannot directly trade on stock exchanges without brokers.

Clearing members

Clearing members are those who help in clearing and settlement of trades through clearing houses.

Clearing house / Clearing corporation

A clearing corporation / agency can be a part of an exchange or can be a separate entity. For example, NSE Clearing Limited (NSE Clearing), a wholly owned subsidiary of NSE is responsible for clearing and settlement of all trades executed on NSE.

A clearing corporation is responsible for clearing and settling all transactions including shares and funds executed in the stock market. It also provides financial guarantee for all transactions executed on the exchange.

Clearing banks

A clearing bank acts as a link between clearing corporations and clearing members. Every clearing member needs to maintain an account with a clearing bank. It is the responsibility of clearing members to maintain sufficient balance to meet obligations.

Regulators

The securities market has lots of market participants and it is important to have a regulator to regulate these participants. Regulators are also important to protect the interests of investors. There are various regulators for different sectors of the market like Ministry of Finance, RBI, SEBI (Securities and Exchange Board of India), IRDA (Insurance Regulatory and Development Authority), PFRDA (Pension Fund Regulatory and Development Authority) etc. For the securities market, SEBI is the regulator.

Let’s understand the major role and functions of SEBI:

Securities and Exchange Board of India (SEBI)

SEBI’s primary role is to promote the development of the securities market, regulate it and protect the interest of investors, by measures it deems fit.

SEBI’s regulatory jurisdiction extends over corporates in the issuance of capital and transfer of securities, in addition to all intermediaries and persons associated with the securities market. It can conduct enquiries, audits and inspections of all concerned and adjudicate offences under the SEBI Act. It has powers to register and regulate all market intermediaries and also to penalize them in case of violations of the provisions of the Act. SEBI has full autonomy and authority to regulate and develop an orderly securities market.

Indian stock market overview

Overview

The Bombay Stock Exchange (BSE) and the National Stock Exchange of India Ltd (NSE) are the two primary exchanges in India. In addition, there are three more operational stock exchanges in the country. However, the BSE and NSE have established themselves as the two leading exchanges and account for about 99% of the equity volume traded in India. NSE is the leading exchange in terms of daily traded volume. The average daily turnover at the exchanges is around 9 lakh crore. There are around 1500 shares listed on the NSE with a total market capitalization of around USD 2.27 trillion. There are over 5000 stocks listed on the BSE and it has a market capitalization of around USD 4.9 trillion. Most key stocks are traded on both the exchanges and hence investors can buy them on either exchange. Both exchanges have a different settlement cycle.

The primary index of BSE is the BSE Sensex comprising of 30 stocks. The NSE has the NSE 50 Index (Nifty) which consists of 50 stocks. The BSE Sensex is older and more widely followed. Both these indices are calculated on the basis of free float market capitalization and contain heavily traded stocks from key sectors. Markets are closed on Saturdays and Sundays. Both exchanges have switched over from the open outcry trading system to fully automated computerized modes of trading known as BOLT (BSE On Line Trading) and NEAT (National Exchange Automated Trading) System respectively. They facilitate efficient processing, automatic order matching, faster execution of trades and transparency. The key regulator governing stock exchanges, brokers, depositories, depository participants, MFs, FIIs and other participants in Indian secondary and primary markets is SEBI. .

Types of investors

An investor is an integral part of the securities market who can provide lending surplus into an economy.

Investors in securities market can be broadly classified into:

- Retail Investors

- Institutional Investors

Retail investors

Retail investors are individual investors who trade and invest in securities for their personal benefit, and not for another company or organization. In an IPO, any investor, who invests less than Rs. 2 lakh is considered a retail investor.

Institutional investors

Institutional investors constitute financial institutions (both domestic and foreign), banks, insurance companies, and asset management companies (Mutual Fund AMC) etc. A foreign institutional investor, also known as FII is a foreign entity that makes investments in India. So, if a foreign investor buys shares in Reliance, it is an FII.

Only institutional investors like investment companies, insurance funds, etc. are allowed to invest in the Indian stock market directly. Hence the term, foreign institutional investor. These investors have to get a license from SEBI.

Person of Indian origin (PIO) & Non-Resident Indian (NRI)

The Reserve Bank of India (RBI) has granted general permission to NRIs and PIOs, for undertaking direct investments in Indian companies under a Portfolio Investment Scheme. NRIs and PIOs do not have to seek specific permission for approved activities under these schemes.

Qualified Foreign Investors (QFI)

Foreign individuals cannot invest directly in India’s markets without sub-accounts with an FII. Qualified Foreign Investors (QFIs) can invest in India without sub-accounts. However, they have to open a demat account and a trading account with a DP in India.

The central government has decided to allow QFIs to directly invest in the Indian equity market and MFs. The QFIs shall include individuals, groups or associations, residents in a foreign country which is compliant with Financial Action Task Force (FATF).

Qualified Institutional Buyers (QIBs)

Qualified Institutional Buyers (QIBs) are institutional investors who are supposed to have expertise in investing in capital markets. These entities are not required to be registered with SEBI as QIBs.

Dematerialization

What is dematerialization?

Dematerialization, demat in short, is the process by which an investor can get physical certificates converted into electronic form maintained in an account with the DP. Investors can dematerialize only those share certificates that are already registered in their name and belong to the list of securities admitted for dematerialization at the depositories.

Advantages of depository services

Dematerialization prevents loss of certificates in transit and saves substantial expenses involved in obtaining duplicate certificates, when original share certificates become mutilated or misplaced. It also helps in increasing liquidity of securities due to immediate transfer and registration. Investors receive bonuses and rights into the depository account as direct credit, thus eliminating risk of loss in transit. With physical certificates, buying and selling were possible only in specified quantities. The convenience of dealing with odd lots or single security was also not available. Demat accounts eliminate this issue.

Procedure of opening a demat account

Opening a depository account is as simple as opening a bank account. You can open a depository account with any DP by following these steps:

- Fill up the account opening form available with the DP. Sign the DP-client agreement which defines the rights and duties of the DP and the person wishing to open the account. Receive your client account number (client ID). This client id, along with your DP id, gives you a unique identification in the depository system.

- There is no restriction on the number of demat accounts you can open. However, if your existing physical shares are in joint names, be sure to open the account in the same order of names before you submit your share certificates for demat.

Procedure to dematerialize your share certificates

- Fill up a dematerialization request form, available with your DP. Submit your share certificates along with the form; (write "surrendered for demat" on the face of the certificate before submitting it for demat)

- Receive credit for the dematerialized shares into your account within two-three weeks.

Stocks traded under demat

SEBI has already specified for settlement only in the dematerialized form for all shares. Investors receive shares only in demat form without any instruction to your broker.

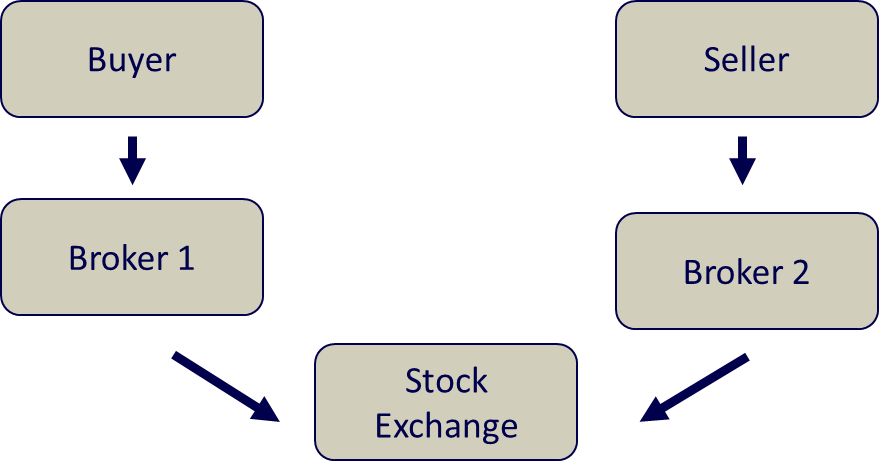

Working of a stock market

To learn more about how you can earn on the stock market, one has to understand how it works. A person desirous of buying/selling shares in the market has to first place an order with a broker. When the ‘buy’ order of the shares is communicated to the broker, they route the order through their system to the exchange. Similarly, the seller also routes their order through their broker. The order stays in the queue of the exchange's systems and gets executed when the ‘buy and ‘sell’ orders match as per given specifications. The shares purchased will be credited in the demat account of the purchaser by the broker.

Types of orders and positions

Order types

There are two ways to place an order on the stock exchange through your broker:

- Market order

- Limit order

Market order means to trade in the stock without negotiating on the price. In this case, your orders will be executed immediately if a stock has enough liquidity. If you are a buyer, you will purchase the quantity from the best available seller. If the best seller does not have sufficient quantity, your order will be matched with the next best available sellers till the time your complete order quantity is fulfilled.

Similarly, in case you want to sell at market price, your order will be matched with the best available buyer. If the best buyer cannot fulfill your order quantity in full, your order will be matched with the next best available buyers.

Let’s understand this with an example:

Following is a demand and supply scenario for a stock:

|

Bid Price |

Bid quantity |

Offer Price |

Offer Quantity |

|

100 |

220 |

100.30 |

40 |

|

99.90 |

50 |

100.40 |

150 |

|

99.75 |

70 |

100.50 |

220 |

|

99.55 |

340 |

100.70 |

320 |

|

99.20 |

200 |

100.85 |

30 |

If you place a market order to purchase 100 shares, your order will be executed at the following prices:

First 40 shares @ Rs. 100.30

Remaining 60 shares @ Rs. 100.40

Average purchase price: [(100.3*40) + (100.4*60)]/100 = 100.36

A limit order means trading at a specific price and trying to negotiate with existing traders to get the best price. If you are willing to sell the share, you may place an order to sell the stock at a price higher than the current price. Similarly, if you are willing to buy the stock, you may place a limit order below the current market price. Limit price order execution will be done only if any buyer/seller is willing to trade on your quoted price.

Types of positions

You can invest in stocks in two ways:

- Delivery-based investment

- Intra-day trading

Delivery-based investment requires full payment of money and shares are then credited to your demat account. You can sell the shares as per your choice, whenever you feel suitable. The time horizon for delivery-based investment can be from one day onward, you can take the help of fundamental analysis to pick the best stocks for investment.

For delivery-based investment, you can use the Flexi Cash feature on ICICIdirect.com for select stocks.

With Flexi Cash, you get the flexibility to buy stocks with lesser funds. For delivery, you need to bring balance funds latest by the next 365 calendar days for positions taken in both NSE and BSE. Interest will be charged on the Position Value funded by ICICI Securities.

Intra-day trading has the time horizon of a single day only, and you need to book profit/loss on the same day. You can also take advantage of leverage which can increase profitability manifold. In case of adverse movement of stock prices, leverage can also multiply your losses that make intra-day trading risky. However, you can take advantage of technical analysis to find the right time to enter and exit in a trade position for increasing chances of profitability in a trade. In intra-day trading, you can take either long or short positions, depending on the expected stock price movement during the day.

Let's understand this with an example:

Suppose you have Rs. 1000 in your trading account and your broker has allowed a leverage of 10 times on the stock of ABC Ltd. which is trading at Rs. 1000. This means you can trade up to 10 shares at a time. If you have purchased 10 shares in the morning and are able to sell all the shares at Rs. 1040 in the afternoon, your profit is 40*10 = Rs. 400. Because of the leverage, your Return on Investment (RoI) is a huge 40% (400*100/1000)

You can carry out equity trading on ICICIdirect.com by placing an order under the 'Margin Buy/ Margin Sell' tab and enjoy higher leverage to maximize your profits. Under Margin order, you can enjoy a leverage of up to 50 times with an option to carry forward your position up to 180 days. Under the Margin Plus feature, you can enjoy a leverage of up to 300 times and protect your losses using mandatory stop-loss order.

Long and short position

Long position

A long position means you are buying the stock first and will sell it later. If you expect the price to rise during the day, you would prefer to purchase the stock first and square off your position later in the day, at a higher price.

Let’s understand this with an example:

Outlook – Bullish

Buy the stock @ Rs. 100 at 9:30 am

Sell the stock @ Rs. 102 at 1:30 pm

Book a profit of Rs. 2 per share

Short position

A short position means you will be selling the stock first and purchase it later to square off your position. If you expect the price to a fall during the day, you would prefer to sell the stock first and square off your position later in a day at a lower price.

Let’s understand this with an example:

Outlook – Bearish

Sell the stock @ Rs. 100 at 9:30 am

Buy the stock @ Rs. 98 at 1:30 pm

Book a profit of Rs. 2 per share

Clearing and settlement

Rolling settlement cycle

In India, the stock market follows the T+2 cycle for settlement. Settlement means pay-in and payout of funds and securities. Pay-in is a process where brokers bring in money or securities, or both, to the clearing house. Pay-out is a process where a clearing house pays money or delivers securities to brokers.

If you trade a stock on Monday, It is going to be settled on Wednesday. In this example, Monday would be considered as Trade day (T day), Tuesday is T+1 and Wednesday is T+2. All Saturdays, Sundays, exchange holidays and bank holidays are excluded from the settlement period calculation. This means that trade carried out on Friday would be settled on Tuesday. This settlement cycle is also known as Rolling Settlement.

Clearing process

At the end of the trading day, based on transactions entered by brokers, the clearing house will be able to determine the total amount of funds and/or securities that the stock broker needs either to receive or to pay other stock brokers. This process is called clearing.

It takes help of clearing members, clearing banks, custodians and depositories to settle with trades.

You can use the e-ATM facility offered by ICICIdirect, wherein the customer will receive fund payouts during the day on the transaction date itself for his/her cash. Unlike the current settlement system, where you receive your money in T+2 working days, which takes up to 3 -4 days in many instances including Saturdays and Sundays), with eATM Orders you will receive your money instantly into your bank account on selling your shares.

Circuit filters

A circuit filter is used by stock exchanges to curb excess volatility in the market. Circuit limit is the maximum fluctuation allowed by the exchange for a particular stock or indices in both directions. This limit varies for different categories of stocks. Trading would be suspended in a particular exchange/stock for a specific time period if the respective index or stock hits the defined limit.

The index-based market-wide circuit breaker system is applicable at three stages of the index movement, either way viz. at 10%, 15%, and 20%. These circuit breakers, when triggered, bring about a coordinated trading halt in all equity and equity derivative markets nationwide. Market-wide circuit breakers are triggered by the movement of either the BSE Sensex or the Nifty 50, whichever is breached earlier.

The market shall re-open after index-based market-wide circuit filter breach.

The extent of the duration of the market halt is as given below:

|

Trigger limit |

Trigger time |

Market halt duration |

|

10% |

Before 1:00 pm |

45 minutes |

|

At or after 1:00 pm up to 2.30 pm |

15 minutes |

|

|

At or after 2.30 pm |

No halt |

|

|

15% |

Before 1 pm |

1 hour 45 minutes |

|

At or after 1:00 pm before 2:00 pm |

45 minutes |

|

|

At or after 2:00 pm |

Remainder of the day |

|

|

20% |

Any time during market hours |

Remainder of the day |

Invest

Invest

COMMENT (0)