Learning Modules Hide

Hide

Chapter 7: Options Trading – Short Put (Put Seller)

Deb studies XYZ Ltd.’s shares for a while and realizes that he expects the price to go up mildly in the near future. He decides to make use of this opportunity by buying a short Put Option on XYZ Ltd. When he calls Subhanshu and advices the same, Subhanshu wants to know the reasoning behind it.

Here’s what Deb tells Subhanshu.

Short Put

A short Put Option is when one has the obligation to buy on an underlying asset. The buyer of a Put Option can then exercise the right to sell the asset at the agreed price.

A short Put Option is useful when you are mildly bullish about the market. Deb is expecting XYZ Ltd.’s shares to stay in the narrow range i.e. either stick to its current price or show slightly upside movement. Therefore, by buying a short Put Option, he can profit from the increase in prices.

|

Did you know? The gain in the short Option position won’t be more than the premium received. |

A short Put Option can be risky because if the underlying asset’s price falls significantly below the strike price, or market price, the loss can be substantial.

Let’s understand this with an example for an underlying security, XYZ Ltd.:

Assume that Subhanshu has sold XYZ Ltd.’s Rs. 1,000 Put Option at a premium of Rs. 50. It means that he has an obligation to buy XYZ at Rs. 1,000 on expiry and has received Rs. 50 from the buyer of the Option. In other words, Subhanshu has an obligation to buy XYZ Ltd. at Rs. 1,000 on the expiry of the contract, if the buyer exercises his right to sell. The buyer will prefer to exercise his right if it is favorable to him i.e. if the price is less than Rs. 1,000.

Let us look at three scenarios within this:

Scenario 1: XYZ closes at Rs. 1,200 on expiry

In this case, the buyer would not prefer to exercise his right to sell XYZ at Rs. 1,000. This means a net gain of Rs. 50 per share for Subhanshu.

Here, Rs. 50 received from the Option buyer is the upfront profit that will be adjusted against any loss that Subhanshu must bear on expiry of the contract.

The breakeven point in this case would be Rs. 1,000 – Rs. 50 = Rs. 950.

Alternatively, we can also calculate the profit/loss with the help of premium paid and premium received.

Premium received = Rs. 50

Premium paid on expiry (equal to intrinsic value) = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 1200)} = Max (0, – 200) = 0

Net profit/loss = Premium received – Premium paid = 50 – 0 = Rs. 50

Scenario 2: XYZ closes at Rs. 800 on expiry

In this case, the buyer would prefer to exercise his right and sell XYZ at Rs. 1,000. This means that Subhanshu will have to buy it at a premium price of Rs. 1,000 in comparison to the market price of Rs. 800. He will incur a loss of Rs. 200 – Rs.50 (Premium received) = Rs. 150 on this position.

Alternatively, we can also calculate the profit/loss with the help of premium paid and premium received.

Premium received = Rs. 50

Premium needs to be paid on expiry (equal to intrinsic value) = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 800)} = Max (0, 200) = Rs. 200

Net profit/loss = Premium received – Premium paid = Rs.50 – Rs.200 = – Rs. 150 i.e. loss of Rs. 150

Scenario 3: XYZ closes at Rs. 950 on expiry

In this case, the buyer would prefer to exercise his right and sell XYZ at Rs. 1,000. It means a loss of Rs. 50 for Subhanshu, but this is netted out by the premium received. So, there won’t be any profit or loss in this case.

As discussed in scenario 1, the breakeven point in this case is Rs. 950, so there won’t be any profit if XYZ closes at Rs. 950.

Alternatively, we can also calculate the profit/loss with the help of premium paid and premium received.

Premium received = Rs. 50

Premium needs to be paid on expiry (equal to intrinsic value) = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 950)} = Max (0, 50) = Rs. 50

Net profit/loss = Premium received – Premium paid = 50 – 50 = 0

The payoff in various scenarios is listed below:

As you can see, buying a short Put Option is useful when one expects the price of an underlying asset to go up a little, i.e. one is mildly bullish about the asset.

Why did Deb not advice a long Call in this case?

Since Deb was expecting only a slight upside, he felt it would be better to take a short Put instead of a long Call.

Let’s get into this with an example:

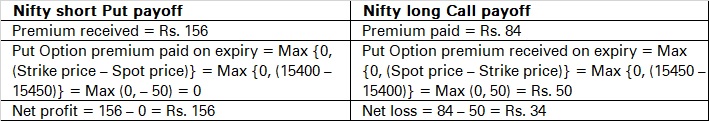

Nifty Spot value on July 17, 2021 = 15,400

Nifty 15,400 Jul 29, 2021 Call Option premium = Rs. 84

Nifty 15,400 Jul 29, 2021 Put Option premium = Rs. 156

Let’s see the payoff, if Nifty moves up by 50 points as per expectation i.e. Nifty’s closing value on expiry = 15,450

Summary

Clearly, it is better to go with a short Put Option if you are moderately bullish. However, writing an Option has higher risks as you may have an unlimited loss.

- A short Put Option is when one has the obligation to buy on an underlying asset.

- A short Put Option is useful when you are mildly bullish about the market.

- The gain in the short Option position won’t be more than the premium received.

- A short Put Option can be risky because if the underlying asset’s price falls significantly below the strike price, or market price, the loss can be substantial.

That brings us to the end of Put Options. Now you must know what an Option is, the two kinds of Options and what it means to go long and short on each. If you don’t, no worries! We’ll summarize them for you in the next chapter.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)