Learning Modules Hide

Hide

Chapter 5: Different Investment Avenues – Real Estate and Gold

“Buy a house!” “Buy gold!”

If you were to ask the elders in your family for advice on where to invest, they are most likely to mention either of these two.

And why not? These investment forms have stood the test of time and reaped good returns for decades. That’s why, even with so many investment options available today, real estate and gold are still regarded as solid investments avenues.

If you are wondering how these types of investment work, and how you can invest in them, here’s what you need to know -

Real estate as an investment avenue

Did you know?

By 2040, the real estate market in India will grow to Rs. 65,000 crores (US$ 9.30 billion).

In India, the real estate market has grown exponentially in terms of financing and investment opportunities. It is a booming sector in India, thanks to rising population and economic growth. Metros, cities and urban areas are seeing an increasing demand in residential and commercial real estate markets.

And with the recent introduction of RERA (Real Estate Regulation and Development Act), real estate purchase has become more straightforward with greater accountability and transparency.

While some enjoy investing in real estate, most others find it tedious.

For instance, a good deal of effort goes into checking out different properties, zeroing on the right one, looking for the right loan, applying for them, stamp duty, registration etc., and the mountain of paperwork!

There must be a simpler way to enjoy the advantages of real estate investments!

Well yes, there is. There are ways to invest in real estate that do not entail buying physical properties.

While traditionally, real estate has been a sound and popular investment asset, you now have the benefit of looking into novel real estate investment options that are affordable and offer similar returns.

Let’s check out all the available options to invest in real estate.

How to invest in Real Estate?

Similar to most other investment assets, real estate offers has two modes of investment:

- Direct investment

- Indirect or through Real Estate Funds

Direct investment

The simplest way to invest in real estate is to buy a piece of land, or invest in commercial assets like shops, apartments and houses directly.

Here, bank finance plays an important role in real estate investing.

Depending on the price and type of property, you are investing in, you may need to pay at least 10% to 25% of the total price out of your pocket. The rest of the investment can be via bank loans.

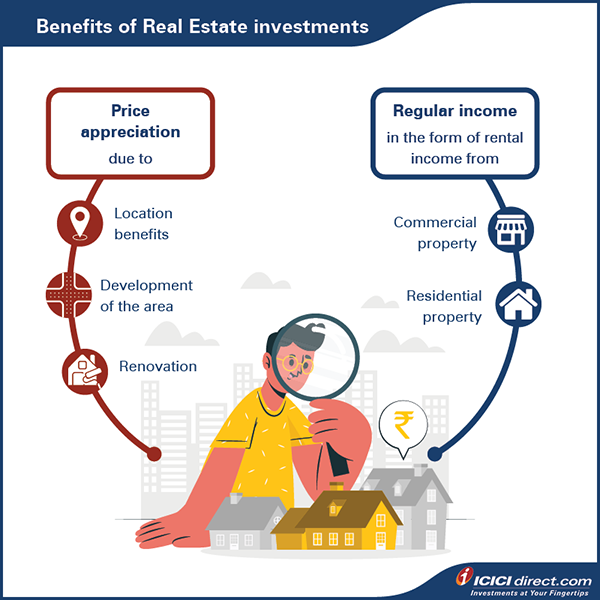

But, how do you earn through direct real estate investments?

Charging rent – Whether you rent out an apartment to a family or an office space to a company, this could be a steady flow of income.

Price gains – Buying a property at a lower price and selling it at a higher price could earn you profits.

Now, what if buying physical property is not an option, given its exorbitant cost? How can one still invest in this lucrative asset without having to put down a lot of money?

That’s where digital investing comes in!

Indirect or Real Estate Funds

This option does not require to take a loan, nor does it involve any cumbersome paperwork.

Real estate funds can be a good if you are looking to invest small sums of money. You can invest in two types of real estate funds:

- Real Estate Funds

- Real Estate Investment Trusts (REIT)

Real Estate Funds in India

Real estate funds offer an alternative option to invest in real estate. Real estate funds invest in a portfolio of REITs, or real estate firms through lending or equity.

They provide investors with the flexibility to invest and the benefit of professional portfolio management. When investing in real estate funds, you need to look out for interest rate risk and market risk. Besides, when investing in a real estate fund, you may not have the liberty of deciding which companies or properties the funds must be invested in and how the fund needs to run.

REITs in India

Compared to other financial instruments and even mutual funds, Real Estate Investment Trusts (REITs) are a recent development in India. REITs officially started in 2014, when SEBI, for the first time, put in place regulations for setting up of REITs in India.

There is still a long way to go for smooth functioning and availability of REITs to smaller retail investors in India. Introduction of RERA (Real Estate Regulatory Authority) Act should help REITs gain more interest with both financial institutions and investors.

Currently there are three REITs available for investment in India. They are:

- Embassy Office Parks REIT

- Mindspace Business Parks REIT

- Brookfield India Real Estate Trust

*as on August, 2021

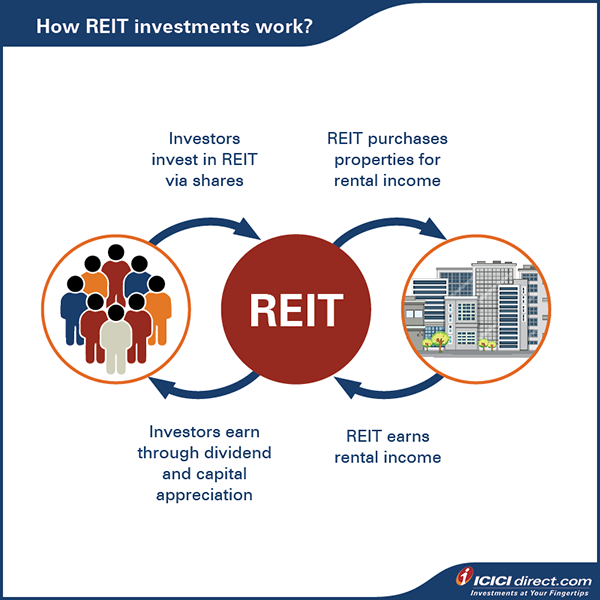

But, as an investor, how can you earn from investing in it?

REITs generate returns through periodic dividends payouts. REITs receive rental income by letting out and leasing the properties.

Additionally, since REITs are listed and traded on stock exchanges, the cost of individual units change based on the performance and market demand. Hence, a good performance by a REIT can lead to a rise in the price of REIT units that you can sell at a profit.

You may think that REITs sound similar to Real Estate Funds. Well, they are not.

The difference between both funds is that REITs generally own real estate assets, while Real Estate Funds invest in a portfolio of REITs, or real estate firms through lending or equity. REITs are better if you are looking for regular income, while Real Estate Funds may offer better capital appreciation.

Now, let’s move on to the second most popular traditional investment avenue – GOLD.

Gold as an investment avenue

In India, the fondness for gold is legendary. In fact, it could even be said that the love for gold can surpass any other boundary. From being used as a form of currency to becoming an important part of our culture, gold has governed people's minds more than any leader or philosophy. It maintains its value even to this day.

But it’s not all in faith. Gold has proved its worth many times before.

This precious metal is regarded as an ideal hedge against inflation. Gold also offers portfolio diversification and, in most cases, have provided decent returns over decades.

Today, gold as an investment is no longer limited to purchasing ornaments or jewellery.

Other than physical gold, you can invest in gold through:

- Gold ETF (Exchange Traded Funds)

- Gold mutual funds

- Sovereign Gold Bonds (SGBs)

Gold ETFs

Gold ETFs are professionally managed funds, which invest in physical gold. When you invest in these funds, you are allotted units, just like any other mutual fund. Over time, the price of these units may appreciate.

Gold ETFs are a close alternative to owning physical gold. They are traded on stock exchanges, and you can buy them through your stock broker. The units are credited to your demat account like stocks.

Gold mutual funds

Goal mutual funds are run by Asset Management Companies (AMCs) and invest in gold ETFs that mimic the movement of domestic gold prices.

Sovereign Gold Bonds (SGBs)

SGB is a scheme by the Government of India to allow investors an alternative and safer route of benefitting from investments in gold.

You can buy the bonds through your stock broker, banks or post office in 1-gram denominations.

Did you know?

London is the largest center for all types of gold trade in the world.

SGBs are safer than holding physical gold and investing in Gold ETFs, as you receive 2.5% annual interest on your total investment for the holding period.

Summary

- The primary way of investing in real estate is to purchase a property. Other forms include REITs and Real Estate Funds.

- Real Estate Investment Trusts (REITs) and Real Estate Funds provide you exposure to the real estate market without possessing, operating, maintaining, or buying tangible properties.

- There are four types of gold investments; Physical Gold, Gold Exchange Traded Funds, Gold Mutual Funds and Sovereign Gold Bonds.

Now that you’ve covered the primary forms of investment avenues, how can you decide on the right investment decision? We find out more in the next chapter on risk versus reward.

Invest

Invest

COMMENT (0)