Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- One of the largest independent retail wealth management services group (excluding banks) in India and amongst the top mutual fund distributors in terms of average assets under management (“AAUM”) and commission received (Source: CRISIL Report as per Company DRHP)

- Offer a technology enabled, comprehensive investment and financial services platform with end-to-end solutions critical for financial products distribution and presence across both online and offline channels (Source: Company DRHP)

One of the largest and fastest growing financial products distribution platforms

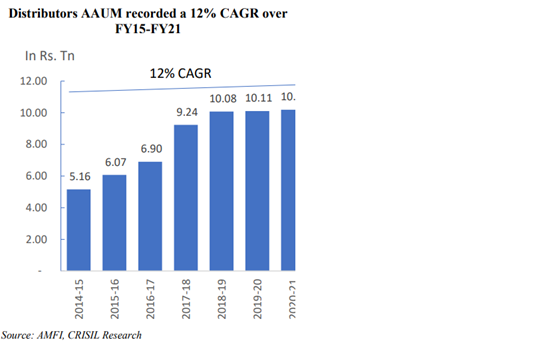

AAUM has grown at a CAGR of 32.5% to ₹ 249,100 million in the five year period from FY16 to FY21 while in the same period mutual funds distributors’ AAUM grew at an approximate CAGR of ~12% and touched ₹ 10.19 trillion in Fiscal 2021 (Source: CRISIL Report as per Company DRHP)

Track record of innovation and use of technology to improve investor and partner experience

Offer digital wealth management (“DWM”) solutions through platforms, namely, FundzBazar, PrudentConnect, Policyworld, WiseBasket and CreditBasket. (Source: Company DRHP)

Pan-India diversified distribution network with ability to expand into underpenetrated B-30 markets

The company believes they are one of the very few national distributors (non-bank) with a strong presence in the B-30 market catering to retail investors in more than 12,600 pin codes across India (Source: Company DRHP)

Operate in a highly regulated environment, which is subject to change

Existing and new laws, regulations and government policies affecting the sectors in which they operate could adversely affect the business, financial condition and results of operations (Source: Company DRHP)

Recommendations, suggestions and advice provided by MFDs using the platform to their clients may be subject to errors or fraudulent behaviour

Such acts by Mutual Fund Distributors are beyond control and any resultant adverse impact to their clients could have an adverse impact on the company's reputation, business and results of operations (Source: Company DRHP)

- Mutual fund penetration : Mutual fund assets in India have seen robust growth, especially in recent years, driven by a growing investor base due to increasing penetration across geographies, strong growth in capital markets, technological progress, and regulatory efforts aimed at making mutual fund products more transparent and investor-friendly (Source: Company DRHP)

- Mutual funds distributors AAUM has doubled in past 6 years : Mutual funds distributors average AUM witnessed a healthy growth of ~12% CAGR over fiscal 2015 to fiscal 2021 and touched ₹ 10.19 trillion in fiscal 2021. So far, banks and NDs have dominated the mutual fund distribution industry, together accounting for ₹ 6.55 trillion of average AUM, as per AMFI’s Commission Report of 2020-21 (Source: Company DRHP)

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

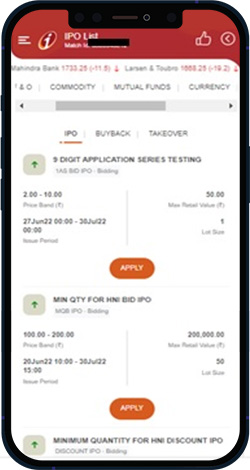

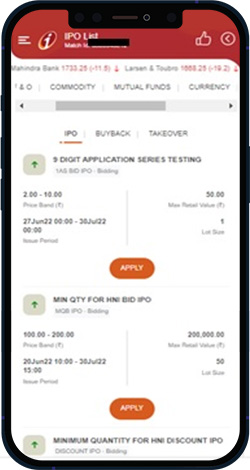

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

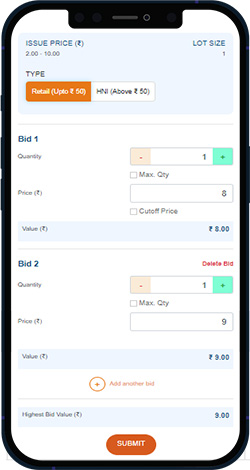

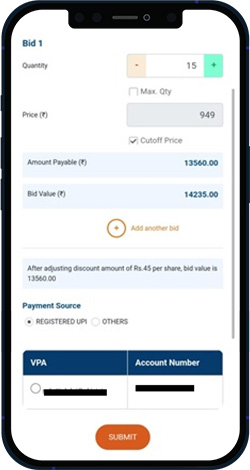

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

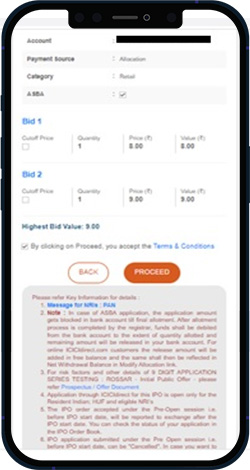

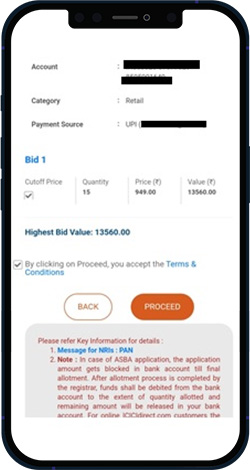

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.