Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

India’s largest cash management company based on number of ATM points and number of retail pick-up points as of March 31, 2021. (Source: Frost & Sullivan).

Cater to broad set of outsourcing requirements for banks, financial institutions, organized retail and e-commerce companies in India.

Operate business in three segments: cash management services, managed services and others.

Leading player in a consolidating market with strong fundamentals

Despite India having one of the lowest ATM penetration rates in the world, India is the third largest ATM market in the world based on number of installed ATMs, after China and the United States, and is expected to grow at a CAGR of 6.16% from 255,000 as of March 31, 2021 to 365,000 as of March 31, 2027. (Source: Frost & Sullivan ; Company DRHP).

Pan-India footprint with deep penetration in growing markets

As of March 31, 2021, of the total number of ATM points the cash management business serviced, 22.61% were metro, 15.48% were semi-metro and 61.90% were semi-urban and rural (Source: Company DRHP).

Longstanding customer relationships leading to increased business opportunities

In the ATM cash management business, the company has had relationships with six of the 12 largest MSP customers for more than ten years. In the retail cash management business, there are relationships with their nine largest customers for more than 10 years.

Business is highly dependent on the banking sector in India

Any adverse development with respect to Indian banks that adversely affects their utilisation of and demand for cash management services or their deployment or utilisation of ATMs could have an adverse effect on the business of CMS Info Systems.

Business is exposed to operational risks for which they have incurred and expect to continue to incur risk costs and penalties

Exposed to various operational risks- including armed robbery, end-customer or third-party fraud, theft or embezzlement by employees or personnel provided by third-party service providers and third-party security service providers.

Cash usage before and during Covid-19

Covid-19 has resulted in a shift in cash usage, with consumers withdrawing bigger sums from ATMs. The average withdrawal size has increased by over 20% compared to the period immediately preceding Covid-19 as people choose to withdraw larger amounts of cash for stockpiling (Source: Company DRHP).

A comparison of India's ATM penetration with other countries

India has one of the lowest ATM penetration rates in the world, with only 22 ATMs per 100,000 individuals, compared to a global average of 47 ATMs per 100,000 individuals.

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

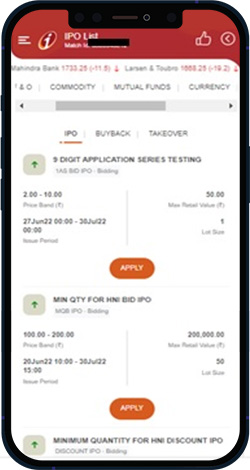

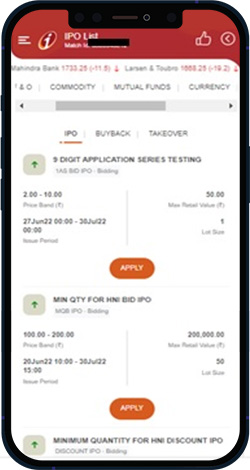

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

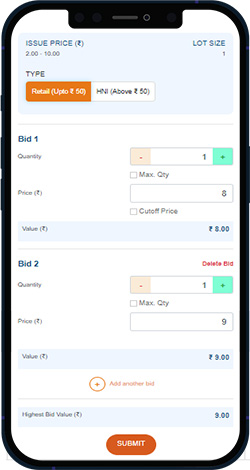

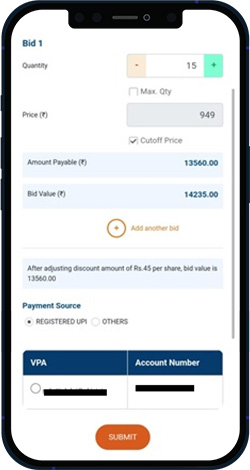

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

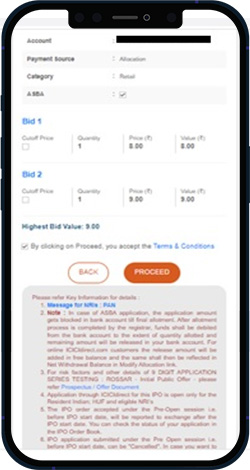

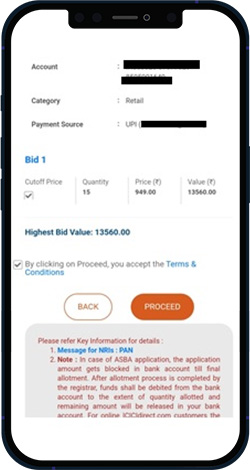

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.