Demerger in GMR Infrastructure : Implications on your F&O positions

GMR Infrastructure Limited has fixed a Record Date of January 12, 2022 for the purpose of issuance and allotment of 1 equity share of GMR Power and Urban Infra Limited for every 10 equity shares to shareholders of GMR Infrastructure Limited.

What has happened at GMR Infrastructure Limited?

GMR Infrastructure had unveiled the rejig plan aimed to simplify the corporate holding structure . Separate listing of both the airport and non-airport businesses is aimed in simplifying the corporate holding structure.

The demerger has led to the creation of a new entity called GMR Power and Urban Infra Limited from the existing GMR Infrastructure Limited.

How does this impact you? Let’s first understand what are De-mergers or Spin-offs?

A demerger is a form of corporate restructuring in which the entity's business operations are segregated into one or more components. A demerger can take place through a spin-off by distributed or transferring the shares in a subsidiary holding the business to company shareholders carrying out the demerger.

What will happen to existing shareholders?

In the demerger, existing shareholders of GMR Infrastructure will receive 1 equity share of Rs. 5 /-(Face value) each of GMR Power and Urban Infra Limited for holding 10 equity shares of Rs.1/- (Face value) share of each GMR Infrastructure Limited. The date of credit shares will be communicated from the Registrar of the company.

The closing price of GMR Infrastructure was Rs 45.8 down nearly 5% on Friday. The stock is up from Rs 31 in July 2021.

What will happen to F&O open positions in GMR Infrastructure?

For clients holding F&O contracts expiring on January 27, February 24, and March 31, these contracts shall now expire on January 10, 2022 and liable to be physically settled if not closed before market hours on January 10.

You can square off existing positions on ICICIdirect on January 10, 2022 or ICICIdirect systems will attempt to close the position by 12 pm if you not have marked this position for physical delivery.

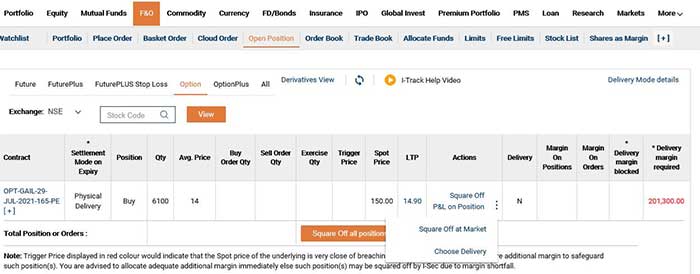

How do I mark my GMR Infrastructure position for physical on ICICIdirect and when do I have to have funds or shares?

To mark a position for physical delivery, you need to visit your ICICIdirect account, open position page before 11 am and a new link to ‘Choose Delivery’ will be available against each stock contract and choose for Physical Delivery.

Suppose you are long on the stock with long futures, short put or buy call and to take physical delivery, you need to allocate equivalent cash of the contract value in your F&O fund allocation.

Suppose you have short futures, long puts or short call and you intend to give delivery of shares, you need to ensure that sufficient free shares in your demat account of GMR Infrastructure.

Suppose I don’t intend to take/ give physical delivery of shares then what am I required to do for my F&O open position?

You need to ensure to close / square off your F&O open position on January, 10.

What if for some reason my position like lack of liquidity couldn’t be squared off on January, 10?

If for some reason your position couldn’t be squared due to lack of liquidity, then In-the-money (ITM) option contract will be assigned to you.

If you are holding long call options and it expires the In-the-money (ITM), the contract will be assigned to you and if you don’t have funds to buy the shares, ICICIdirect will be forced to buy the stock on your behalf and sell next day. The equivalent profit or loss along with statutory charges will be passed to your account.

If you are holding long put options and the contract expires in-the-money (ITM), you will have to have shares to give delivery. In case the shares are not there in your demat account, it will go for auction. ICICIdirect will attempt to arrange the stock in Stock lending and borrowing scheme (SLBM) and give delivery of shares on your behalf and then sell. The loss on such transaction (difference between buy or sell will be debited to your account. If any profit, that also will be credited to your account.

What will be final price of GMR Infrastructure be on January, 10 and when will the settlement happen?

For final settlement, the weightage average price as determined by NCL under the interoperability framework will be considered.

The Pay in/pay out of final MTM settlement of all Futures contracts on GMRINFRA shall be on January 11, 2022 (T+1 day).

The physical settlement shall be effected on January 12, 2022 (T+2 day).

New contracts of GMR Infrastructure will be available for trading from 11th January 2022.

We will urge you to monitor your positions and take timely action on this.

Disclaimer:-

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)