All you need to know about Escorts Open Offer!

ESCORTS Limited board announced that Kubota Corporation has made an open offer to acquire Rs. 7,500 crore shares open offer through an off -market transaction

Brief information about ESCORTS: -

Escorts Limited is engaged in manufacturing engines for earthmoving and material handling equipment, agricultural tractors, hydraulic shock absorbers, internal combustion engines, etc. used by railways and has a market capitalization of Rs. 23,878 crores as of 15th March 2022. The company was incorporated in 1944. The Bombay Stock Exchange (BSE) and National Stock Exchange have assigned code 500495 and scrip code ESCORTS. As of 15th March 2022, Escorts was trading at Rs.1810.

Escorts is an Indian multinational conglomerate located in Faridabad, Haryana. The corporation has marketing operations in over 40 countries and focuses on three core businesses: agricultural machinery, construction equipment, and railway equipment. Agri Machinery contributes 77% of revenue, Construction Equipment contributes 15% of revenue and Railway Equipment contributes 8% of revenue. The company manufactures tractors under brand names Powertrac, Farmtrac, and Steeltrac. During the period 2020-21, the company achieved a historic milestone of 1,00,000 tractor sales & production in a financial year had sold approximately 1,06,741 tractors.

What is an open offer background?

On November 18, 2021, Escorts' board had announced that Kubota will acquire 3,74,91,556 or 28.42% additional shares through preferential allotment plus open offer at a price of Rs 2,000 per share & it’s a 10 % premium to the current market price of the stock as on today.

Who is Kubota?

Kubota is the Japanese agri machinery and construction equipment major & currently which owns 9.09 per cent stake in the Escorts. Kubota is expected to increase its holding to 53.5 per cent through preferential issue of equity, open offer and equity reduction.

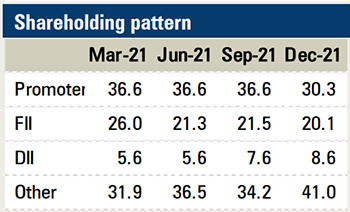

What is shareholding pattern of ESCORTS?

Source: - ICICIdirect Research

Price performance of ESCORTS: -

Source: - ICICIdirect.com

What is an open offer?

An open offer is an offer made by the acquirer to the shareholders of the target company inviting them to tender their shares in the target company at a particular price.

What are the shares tender period for open offer?

ESCORTS tender windows will open from 14th March and closing date is 28th March 2022.

Can clients apply online through ICICIdirect.com?

No, this is off - market transaction. Registrar will send form to client.

Who is the registrar for open offer?

KFin Technologies Private Limited.

What is the name & details of the escrow account?

Name: - KFIN TECHNOLOGIES ESCORTS OPEN OFFER ESCROW DEMAT ACCOUNT

DP Name: ICICI Bank Limited

DP ID: IN301348

Client ID: 20200624

How can clients apply through off – market transactions?

Client needs to transfer shares in KFIN TECHNOLOGIES escrow account with the duly filled DIS (Delivery instruction) slip & submit with the relevant document at nearest ICICI Bank demat desk.

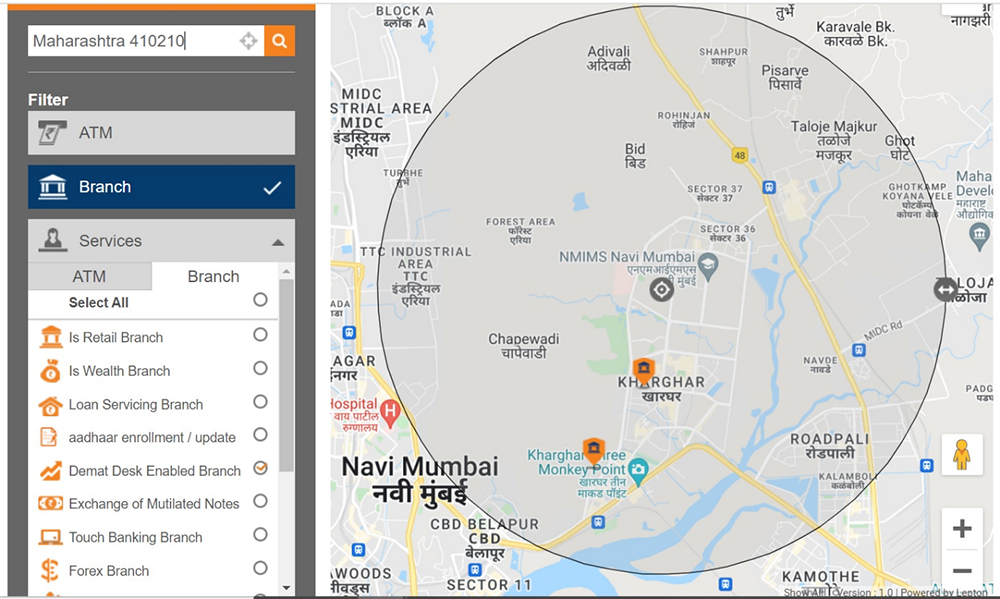

How to find the nearest demat desk of ICICI Bank Ltd?

With the help of below link of branch locator, find the nearest demat desk of ICICI Bank Ltd. In services option please highlight on demat desk.

Link: - http://bit.ly/3igeVVb

How can clients get any confirmation from ICICI Bank demat desk after submitting DIS slip?

ICICI Bank will give acknowledgement to the client.

Procedure to be conducted (if the below discrepancies arise) -

- If the client does not receive a form from the registrar?

Clients can download the letter of offer from nseindia.com or bseindia.com or Click here to download & take print out of form on page 72.

- If a client doesn't have a DIS slip?

Clients can visit any nearest ICICI Bank demat desk and ask for single DIS slip.

Client needs to send the Form of Acceptance-cum-Acknowledgement to the Registrar?

Yes, The Form of Acceptance-cum-Acknowledgement & Photocopy of the delivery instruction in “Off-market” mode or counterfoil of the delivery instruction in “Off-market” mode, duly acknowledged by the DP as per the instruction in the Letter of Offer along with enclosures should be sent only to the Registrar to the Offer either by Registered Post or Courier or hand delivery so as to reach the Registrar of the Offer on or before the date of closure of the Tendering Period at its registered office on all Working Days (excluding Saturdays, Sundays and Public holidays) during the business hours.

What precautions need to be taken for shareholders before transferring shares to an escrow account?

Shares are free from any pledges, liens, charges, equitable interests, non-disposal undertakings or any other form of encumbrances

What will be the Acceptance Ratio?

As per the shareholding pattern, the minimum acceptance ratio is 51 per cent.

e.g. out of every 2 shares 1 share will be accepted in open offer.

Source: - ICICIdirect Research

Client will be eligible for open offer If buy share?

Yes, clients who can buy shares before 23rd March will be eligible for open offer.

When shareholders get confirmation of shares acceptance?

The last date of communicating the rejection/ acceptance and completion of payment of consideration or refund of equity shares to the shareholders is April 11, 2022.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning, Investment Advisory etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)