Nagarjuna Construction Company Limited (NCC) is a construction & Engineering small-cap engaged in construction activities in the infra sector. It is involved in constructing commercial buildings, water supply, and environment projects, roads, bridges, and hydrothermal power projects. The company features a market capitalization of Rs. 4890.97 crores as of 16th August 2021. It was incorporated in the year 1978. It has reported its quarterly consolidated revenue of Rs. 2083.21 crores (including other income). The Bombay Stock Exchange (BSE) and National Stock Exchange have assigned the number 500294 and scrip code NCC. As of 16th August 2021, NCC was trading at Rs. 81.20.

NCC is primarily engaged within the infrastructure sector; apart from India, it also features a world presence in Oman and United Arab Emirates. The company’s areas include Buildings & housing, Roads, Electrical, Water & Environment, Irrigation, Railways, Power, and Metals & Mining. During the last 4 decades, NCC had advanced from just a housing industry player to a billion-dollar multinational infrastructure conglomerate. The company’s goal is to be a world-class infrastructure & construction enterprise contributing towards maximizing stakeholders' wealth. The promoters’ holding within the company stood at 19.68% in June 2021 as against 19.31% within the corresponding quarter a year ago. Pledged promoter holding stood at 3.28%.

In June 2021, on a consolidation basis, the company features a turnover of Rs. 2083.21 crores as against Rs. 1328.71 crores within the quarter ending June of the previous year, increasing by 57%. The company has reported EBIDTA of Rs. 211.25 crores and a net profit attributable to shareholders of the company of Rs. 49.95 crores as against Rs. 124.82 crores and Rs. 15.68 crores respectively reported in the corresponding quarter of the previous year, an increase of 69% in EBIDTA. The company has posted basic and diluted EPS of Rs. 0.82 for June 2021 quarter as against basic and diluted EPS of Rs. 0.26 in the corresponding quarter of the previous year. Shares of NCC closed at Rs. 81.20 as of 16th August 2021 and has returned 145.69% over the last 12 months.

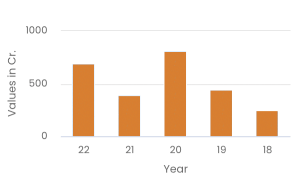

NCC share price as on 19 Apr 2024 is Rs. 242.5. Over the past 6 months, the NCC share price has increased by 53.38% and in the last one year, it has increased by 122.17%. The 52-week low for NCC share price was Rs. 99.65 and 52-week high was Rs. 278.05.

Invest

Invest