Resistance and support

4,061.22

| Financials( ₹ in Cr) | J K Cements Ltd | UltraTech Cement Ltd | Ambuja Cements Ltd | Shree Cement Ltd | ACC Ltd |

|---|---|---|---|---|---|

| Price | 4,031.55 | 9,683.75 | 638.35 | 23,971.60 | 2,579.60 |

| % Change | -3.44 | 0.26 | -0.95 | -1.63 | 0.91 |

| Mcap ₹ Cr | 31,150.98 | 279,562.12 | 140,288.65 | 86,491.93 | 48,441.53 |

| Revenue TTM ₹ Cr | 9,720.20 | 61,326.50 | 28,965.46 | 17,852.33 | 16,151.67 |

| Net Profit TTM ₹ Cr | 419.08 | 4,916.88 | 3,711.04 | 1,269.14 | 1,863.10 |

| PE TTM | 44.76 | 43.59 | 38.69 | 38.46 | 22.62 |

| 1 Year Return | 39.43 | 30.15 | 67.85 | 0.42 | 48.71 |

| ROCE | 9.66 | 12.86 | 21.37 | 8.51 | 18.51 |

| ROE | 9.30 | 9.62 | 15.43 | 7.03 | 13.80 |

Equity Capital: 4,686.75 Cr FV: 10.00

| Period | MF Net Purchase / (sold) | FII Net |

|---|---|---|

| LAST 1M | 20,210.21 | -2,288.40 |

| LAST 3M | 84,754.55 | 29,178.29 |

| LAST 6M | 143,739.62 | 78,000.86 |

| LAST 12M | 219,616.53 | 194,185.36 |

| Date | Action Type | Ratio |

|---|---|---|

| Aug 01, 2023 | Dividend | 150 |

| Aug 02, 2022 | Dividend | 150 |

JK Cement Ltd manufactures and sells cement and cement-related products in India and 42 other countries. The company manufactures grey cement, white cement, and allied products. Its first grey cement factory was established in Nimbahera, Rajasthan, in May 1975. The company has 12 RMC plants across India.

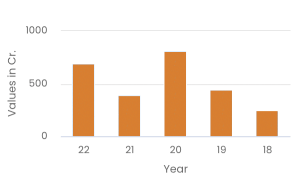

In 2022, JK Cement Ltd earned Rs 7,991 crore in revenue, making a profit of Rs 687 crore. The company’s revenue in 2022 witnessed a 21% hike compared to 2021, while the profit made by the company in 2021 was higher by 3.34%.

JK Cement Ltd is listed on the Bombay Stock Exchange with the code 532644 and on the National Stock Exchange with the ticker JKCEMENT. On November 24, 2022, JK Cement Ltd’s market capitalisation was Rs 22,788 crore.

JK Cement Ltd is one of the largest manufacturers of grey cement in India and one of the world’s largest manufacturers of white cement. The company has an installed grey cement capacity of 20 MnTPA. It has a white cement capacity of 1.20 MnTPA, making it one of the global leaders in white cement manufacturing. JK White Cement is sold across 43 countries. The company has a formidable international presence with two subsidiaries.

As of November 24, 2022, 45.84% of the company’s shares are held by the promoters, mutual funds have a 19.99% stake, retail shareholders have a 14.64% stake, foreign institutional investors own 16.06% of the shares, and financial institutions own only 1.1% of the company’s shares.

A 13-member board of directors helms the company. The members of the board of directors are Sushila Devi Singhania, Raghavpat Singhania, Madhavkrishna Singhania, A.K. Saraogi, Nidhipati Singhania, Paul Hugentobler, Sudhir Jalan, Ashok Sinha, Deepa Gopalan Wadhwa, Mudit Aggarwal, K. B. Agarwal, Saurabh Chandra, Satish Kumar Kalra, and Ajay Narayan Jha.

On November 24, 2022, JK Cement Ltd share price closed at Rs 2,953.05, up 0.13% from the open price of Rs 2,942.95. The company’s share prices have risen 156% in the past three years and dropped by 14.40% in the past 12 months. Nevertheless, the stock had a good one month with a growth of 10.06%. On November 24, 2022, the share’s 52-week high was Rs 3,659.25, and the 52-week low was Rs 2,003.70.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code: 07730), BSE Ltd (Member Code: 103) and Member of Multi Commodity Exchange of India Ltd.(Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. Investors should consult their financial advisers if in doubt about whether the product is suitable for them. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

| AGM Date (Month) | : | Aug |

| Face Value Equity Shares | : | 10 |

| Market Lot Equity Shares | : | 1 |

| BSE Code | : | 532644 |

| NSE Code | : | JKCEMENT |

| Book Closure Date (Month) | : | Aug |

| BSE Group | : | A |

| ISIN | : | INE823G01014 |

You can buy J K Cements Ltd shares through a brokerage firm. ICICIdirect is a registered broker through which you can place orders to buy J K Cements Ltd Share.

Company share prices and volatile and keep changing according to the market conditions. As of Apr 25, 2024 04:03 PM the closing price of J K Cements Ltd was ₹ 4,031.55.

Market capitalization or market cap is determined by multiplying the current market price of a company’s shares with the total number of shares outstanding. As of Apr 25, 2024 04:03 PM, the market cap of J K Cements Ltd stood at ₹ 31,150.98.

The latest PE ratio of J K Cements Ltd as of Apr 25, 2024 04:03 PM is 44.76

The latest PB ratio of J K Cements Ltd as of Apr 25, 2024 04:03 PM is 0.16

The 52-week high of J K Cements Ltd share price is ₹ 4,575.00 while the 52-week low is ₹ 2,893.00

According to analyst recommendations, J K Cements Ltd Share has a “Buy” rating for the long term.