Incorporated in 1992,Heranba Industries Ltd is engaged in manufacturing of agrochemical products.The company produces synthetic Phrethroids and its intermediates.The product portfolio includes insecticides,fungicides,herbicides,plant growth regulators and other related agrochemical products.The company is having a fully equipped in-house laboratory with all laboratory equipments such as HPLCs,GCs,Polarimeters,Particle size Analysers,Spectrophotometers and other conventional lab equipments.Presently the company also provides processing services for Ammonolysis,Esterification,Hydrolysis,Condensation,Favorski Reaction,Isomerisation,Cyanation,Friedel Crafts,Methoxylation,Cyclisation,Halogenation,Sulphonation etc.

Heranba has fully integrated and modern manufacturing facilities with an In-house R&D facility for product development and process intensification.The company`s manufacturing facilities are situated in the industrial belt of Vapi,Gujarat.The company has an aggregate manufacturing capacity of 14024 MTPA.These facilities offer a range of Crop Protection and Public Health Solutions.The company has three manufacturing units,two units are involved in the production of various technicals and intermediates,while the third plant is engaged in formulation and packaging.

The first manufacturing facility of Heranba produces technical grade Synthetic Pyrethroids like Cypermethrin, Deltamethrin, Alphacypermethrin and Permethrin, alongwith other products like Glyphosate, Acephate, Imidacloprid, Profenophos, Temephos, Clodinofop Propargyl, Tricyclazole, Thiamethoxam, Lambdacyhalothrin, Bromobenzene, Metaphenoxy Benzaldehyde (MPBD), Metaphenoxy Benzyl Alcohol (MPBAL). The second plant manufactures high quality derivatives of Cypermethric Acid Chloride as per customer`s requirement. Cypermethrin and Alphacypermethrin Technical are also manufactured in this plant.

The third plant of Heranba`s ISO 9001: 2015 certified unit with modern formulation and Packing facility capable of handling large capacities of liquid, Powders and Granules. It specialises in various formulations such as EC, SC, CS, FS, WP, WDG and Granules and many more formulations to cater to the Indian market as well as for export.The company has bagged the Chemexil award for Large Scale Manufacturer and Exporter 2016-17. The company also won the Overseas Market Expansion Award 2018 in CAC,China.

Heranba Industries has established its presence in CHINA with an office in Titanning District, Changzhous, Jiangsu, China.The Company has recently acquired additional plots at Saykha and Sarigam, both situated in Gujarat, India for their growth plans, where the company has planned to come up with more advanced Technicals, with the help of their In-house Research & Development. During the FY2019, the Company has redeemed its entire Preference Share Capital of Rs. 25,12,100 divided into 25121 Preference Share of Rs. 100/- each.

The company also issued and allotted 3,12,45,224 Equity Shares of Rs.10 each as Bonus Equity Shares in the proportion of 4 equity shares for every 1 existing equity shares held by the Members.

During the FY2020, a new Wholly Owned Subsidiary Company was incorporated in china under the name of Chang Zhou Heranba Crop Science and Technology Co., Ltd. The Company shall subscribe to all the Share Capital of the aforesaid Subsidiary Company in China however the company has not yet remitted the fund to subscribe to the Subscribed Capital of the aforesaid Subsidiary Company in China.

The company has come out with Rs 625 crore IPO in February 2021,offered upto 99.8 lakh shares with 90.20 lakh shares under offer for sale and the rest through fresh issue of shares.The company has successfully completed its IPO and the shares of the company were listed in BSE and NSE on 05 March 2021.

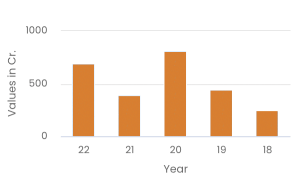

Heranba Industries share price as on 24 Apr 2024 is Rs. 326.55. Over the past 6 months, the Heranba Industries share price has decreased by 8.04% and in the last one year, it has decreased by 12.63%. The 52-week low for Heranba Industries share price was Rs. 282.55 and 52-week high was Rs. 426.

Invest

Invest