Pharmaceutical company Pharmaceutical company GlaxoSmithKline Pharmaceuticals announced Q3FY24 results:

Revenue and Profitability:

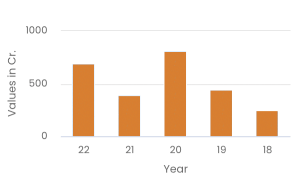

- Revenue from operations at Rs 805 crore for Q3FY24.

- The company announced a Profit before exceptional items and tax at Rs 228 crore.

- EBITDA margins were reported at 27%.

Market Performance:

- GSK experienced a 1% value growth in a flat general medicine market during the quarter, notwithstanding the impact of the National List of Essential Medicines (NLEM).

- Augmentin continued to lead, improving its market share and retaining the number 1 rank within the Indian Pharmaceutical Market (IPM).

Product Portfolio and Strategic Developments:

- The Vaccines market and portfolio of GSK continued to exhibit sequential growth.

- The company is focusing on newer capabilities to improve reach and access for its innovative portfolio, which includes products like Shingrix, Nucala, and Trelegy.

Commenting on the results, Bhushan Akshikar, Managing Director, GlaxoSmithKline Pharmaceuticals, said, "We remain committed to new category development in areas like Adult Immunization with products like Shingrix to make a positive impact on the lives of patients in India. We will continue to drive operational efficiency and explore new innovative solutions including Omnichannel Strategy to expand reach and coverage to the target segments."

Invest

Invest